The Coinbase Conundrum: Providing Accurate Tax Information To Users

Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. As of this writing, Coinbase boasts more than 25 million users on its platform. As impressive as this stat is, it comes as a bit of a shock that when it comes to Coinbase taxes, the exchange is unable to provide accurate documentation to millions of its users. This article breaks down why Coinbase taxes are so problematic and offers a solution to the problem.

Does Coinbase Wallet Provide A 1099 Form To The Irs

No. As a non-custodial wallet, Coinbase Wallet holds no KYC details and cannot issue a 1099 form to you or the IRS. However, if you’re using Coinbase Wallet in conjunction with other Coinbase products like Coinbase Exchange or Coinbase Pro, both these platforms may issue 1099-MISC forms to any US investors who earned $600 or more in miscellaneous income such as rewards or fees from Coinbase Earn, USDC Rewards, and/or staking in 2021

Remember, whenever you get a 1099-MISC form, the IRS gets an identical copy. You can learn more about crypto 1099 forms in our blog.

Can Coinbase Calculate My Taxes For Me

Due to the inability for Coinbase to have accurate insight into any of your non Coinbase Pro trading activity, Coinbase likely isn’t going to be able to provide you with accurate crypto tax documentation. What this means for you, the crypto trader, is that you’ll likely end up paying more in taxes than you need to as the cost-basis for your assets will be wrong .

If you want a complete picture of your cryptocurrency tax situation, you’re going to want to use a tool like Ledgible to track your crypto trades and tax burden. For consumers and tax professionals, Ledgible is completely free to use throughout the year. This means you can use Ledgible for tax planning purposes in order to minimize your tax burden while making active trades. Ledgible is the only professional and consumer platform that’s independently SOC 1 & 2 audited to ensure proper security, and since Ledgible runs its own on-chain nodes, its one of the only platforms that can provide accurate cost-basis calculations for active traders. You can learn more here.

Read Also: Sales Tax Exempt Form Ny

Does Coinbase Send A 1099

As discussed earlier, Coinbase cannot calculate their customersâ taxes if they make transactions outside of the platform. Because of this limitation, Coinbase does not send 1099-B’s with cost basis information like traditional brokerages.

This may change in the near future.

The American infrastructure bill will require major cryptocurrency exchanges to send 1099-B forms to customers and the IRS. However, since most cryptocurrency investors use multiple exchanges, itâs likely that these forms will have incomplete information.

Ultimately, itâs up to you to keep a complete record of your cryptocurrency transaction history. CoinLedger will do this automatically for you. The platform can integrate with Coinbase and any other platform you are using to make filing your taxes easier than ever.

Coinbase Taxes: The Takeaway For New Traders

Coinbase taxes factor into your report to the IRS. Crypto trading seems like an investment that requires less reporting than your other earnings. However, the IRS needs detailed information about your gross transaction earnings this calendar year. Go on your Coinbase account to find your complete transaction history so you can make sure to accurately report your earnings and stay in good standing with the IRS in 2021.

Read Also: Who Pays Property Taxes In An Irrevocable Trust

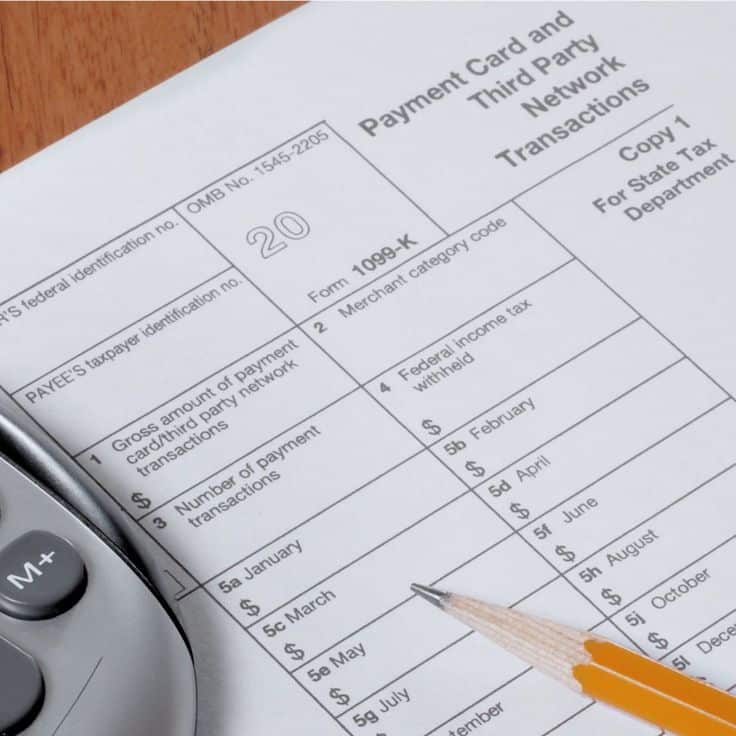

What Are 1099 Forms

1099 forms are designed to provide information to the Internal Revenue Service about certain types of income from non-employment-related sources. Put another way, 1099 forms are designed to report income that you received that wasnât from your employer.

While there are many different types of 1099 forms, weâll focus on three relevant ones in this article.

Form 1099-K: This form is commonly used by credit/debit card networks and other payment settlement networks. The form shows the IRS the transaction volume of processed payments.

Form 1099-MISC: This form is used to report âmiscellaneousâ income to the IRS. Rewards from referrals and staking would fall into this âmiscellaneousâ category.

Form 1099-B: This form is used to share information about property/security disposals made through a broker. You may be familiar with this form if youâve used stock exchanges like Robinhood or E-Trade.

How Are Crypto Transactions Reported

When you place crypto transactions through a brokerage or from using these digital currencies as a means for payment, this constitutes a sale or exchange. As a result, youll need to document your crypto sales details, including how much you bought it for and when. These transactions are typically reported on Form 8949, Schedule D, and Form 1040.

Read Also: Tax Id Numbers For Businesses

Why Do You Need To File Us Taxes If You Have A Coinbase Account

For first-time cryptocurrency buyers and long-time crypto-enthusiasts alike, the new filing requirements for reporting Coinbase accounts may be confusing. After all, the IRS has only recently begun introducing tax filing guidelines for cryptocurrency. To get a better understanding of these requirements, U.S. taxpayers should learn why they exist at all.

Cryptocurrency is a relatively new phenomenon. The IRS has taken time to decide how to treat this money-making venture, and its still ironing some things out. However, the IRS has generally chosen to treat cryptocurrency as property instead of cash. Of course, there are some exceptions to this, like when Americans get compensated for work by their employer through Coinbase accounts. However, generally speaking, cryptocurrency is considered property.

In the United States, you often have to pay taxes on transactions involving property and financial assets. If you have a Coinbase account and buy or sell crypto using it, its the same as buying or selling property. Any income you earn as a result of such transactions is considered taxable. Its important to understand that the IRS is privy to many transactions you make using your Coinbase account. Coinbase sends such information to the tax collection agency annually.

Features That Could Be Improved

- “Free” account won’t let you download tax forms, so its not really free.

- No additional features beyond tax preparation

- User interface can be a little bit unclear at times

For these reasons, we recommend Koinly for users who need very minimal features of their tax software and just want to produce tax forms quickly.

Recommended Reading: Your Tax Return Is Still Being Processed 2022

Tax Forms Explained: A Guide To Us Tax Forms And Crypto Reports

Can’t tell a 1099 from a 8949? Our guide to the 2021-2022 federal tax forms every U.S. crypto trader should know.

If youre reading this, its probably everyones favorite time of year: tax season. As you figure out your tax bill, you might come across different forms and reports that try to capture how you used your crypto whether you sold, staked, or HODLed. Figuring out what you owe on your assets can be tricky, even for the most seasoned tax professionals, so to help you avoid any issues with Uncle Sam, lets break down a few common forms. Well explain whats on each document, why you received it, and when youll need it.

First things first…

Coinbase doesnt provide tax advice. This article represents our stance on IRS guidance received to date, which may continue to evolve and change. None of this should be considered as advice or an individualized recommendation, but its important to us that our readers have relevant information available to them in the most accessible way possible. Please consult a tax professional regarding your own tax circumstances.

How To Calculate Capital Gains And Losses On Crypto

When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. How the IRS treats these two classes is very different in terms of the tax consequences youll encounter.

When calculating your gain or loss, you start first by determining your cost basis on the property. Generally, this is the price you paid, which you adjust by any fees or commissions you paid to engage in the transaction. This final cost is called your adjusted cost basis.

Next, you determine the sale amount and adjust it by any fees or commissions you paid to close the transaction.

Finally, you subtract your adjusted cost basis from the adjusted sale amount to determine the difference, resulting in a capital gain if the amount exceeds your adjusted cost basis, or a capital loss if the amount is less than your adjusted cost basis.

You can use a Crypto Tax Calculator to get an idea of how much tax you might owe from your capital gains or losses from crypto activities.

You May Like: Rv Sales Tax By State

Does Coinbase Issue 1099s And Report To The Irs

Tax season is upon us, and its time to start asking the question on everyones minds this year: What do you need to do to accurately report cryptocurrency earnings to the IRS?

Coinbase is one of the largest crypto exchange platforms out there, with approximately 73 million verified users, according to their website.

Are you among the users who sold or converted crypto on Coinbase in 2021? If so, you may be asking if Coinbase will give you Form 1099, and what else youll need to prepare to pay your taxes this year. Lets find out which tax documents Coinbase provides, how you can prepare your tax forms, and what Cointelli can do to help streamline the process.

Us Tax Filing Requirements For Coinbase Accounts Owners

Having a Coinbase account to buy or sell cryptocurrency can be extremely lucrative for U.S. residents and expats alike. However, with purchasing and holding such assets comes tax filing requirements that many Americans may be unfamiliar with. If you have a Coinbase account, you may have to report your earnings and holdings to the IRS. In some instances, you may need to pay taxes, too.

Recommended Reading: Rental Property Income Tax Calculator

Coinbase Wallet Tax Api

Using the Coinbase Wallet API – you can easily fetch your transaction data to your chosen crypto tax software. Just get your public address from the blockchain you want to connect with your crypto tax app. You can find this in the Coinbase Wallet app at the top of the extension. You’ll need to do this for each blockchain you use to interact with using Coinbase Wallet – for example, Ethereum, Solana or Avalanche C-Chain. Once you have your public address, just navigate to your crypto tax tool, add a new wallet and paste your public address. You can see full instructions on integrating Coinbase US with Koinly here.

How To Prepare For Tax Season When You Have Crypto

The best thing you can do to simplify your crypto-related 2021 tax filing is start planning ahead now. Dont wait until April 1, 2022, to begin gathering your reports and figuring out what you owe, even if thats how you typically approach tax season.

You do not want to be in the situation in April where youre trying to catch up with one years worth of crypto activity, White says. You really want to treat it more like a business, where on a monthly basis you are making sure that all of your taxes are up to date, making sure you are tracking things correctly, and being more proactive about it.

If youre just dipping your toes into trading Bitcoin or another cryptocurrency, and only have a few transactions , you may be able to easily report your crypto earnings yourself using your typical tax software.

Most people are pretty simple: they have a W-2, they have a couple 1099 interest forms, and they may have some crypto, Chandrasekera says. So those people dont really need a CPA. But if youre somebody dealing with large amounts of money, youre making DeFi transactions, staking or mining operations, those people will want to have a CPA to sit down and do tax planning and tax-saving strategies.

Don’t Miss: Look Up State Tax Id Number

For Federal Tax Purposes Virtual Currency Is To Be Treated As Property

Where Can I Download My Transaction History

You can download your transaction history in the Reports section of Coinbase.com and the statements section of Pro to download Pro transactions.

To calculate your gains/losses for the year and to establish a cost basis for your transactions, we recommend connecting your account to CoinTracker. Learn more about .

Recommended Reading: How Much Is Tax At Walmart

Coinbase 109: What To Do With Your Coinbase Tax Documents

Back in 2020, Coinbase announced that they would no longer issue Form 1099-K to their users, and instead would issue Form 1099-MISC to certain users for tax year 2020 and beyond. This was great news for users of the largest cryptocurrency exchange in the US, since the 1099-K created some major tax headaches.

However, the 1099-MISC from Coinbase still may not provide everything you need to properly report crypto taxes.

Read on to learn more about why this form is issued, who receives it, and what to do with this tax form.

Our free, on-demand cryptocurrency tax webinar explains how to complete your tax return step-by-step. Youll also get a free download with reporting instructions!

What does the Coinbase 1099-MISC report?

The 1099-MISC from Coinbase includes any rewards or fees from Coinbase Earn, USDC Rewards, and/or staking that a Coinbase user earned in the previous tax year. It does not include any income made from selling and trading crypto, nor will it cover other taxable transactions such as purchases of goods or services made with crypto.

Who receives a 1099-MISC from Coinbase?

According to the company website, you will receive this tax form from Coinbase if:

- You used Coinbase, Coinbase Pro, or Coinbase Prime in 2020 or beyond

- AND you earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, or staking during the year

What to do with Coinbase tax documents

Does Coinbase report to the IRS?

About the Form 1099-K from Coinbase

How Is Cryptocurrency Taxed

Cryptocurrencies like Bitcoin are treated as property by the IRS and many other governments around the world. Other forms of property that you may be familiar with include stocks, bonds, and real-estate.

Just like these other forms of property, cryptocurrencies are subject to both capital gains and income taxes. You will be required to report taxable events on your tax return.

Youâll incur capital gains or losses if you sell your cryptocurrency, trade it for other cryptocurrencies, or use it to buy goods and services.

Meanwhile, earning cryptocurrency through staking, mining, or interest rewards should be reported as personal income and will be taxed accordingly.

For a complete and in-depth overview, please refer to our Ultimate Guide to Cryptocurrency Taxes.

Recommended Reading: Sales Tax Rate In Chicago Il

Crypto Tax On Capital Gains

If you invested in cryptocurrency by buying and selling it, you would report all your capital gains and losses on your taxes using Schedule D, an attachment for Form 1040.

Remember that if you made money on crypto exchanges but held it for one year or less, then its considered a short-term capital gain and it would be taxed as income. Your federal tax rate would range from 10-37 percent depending on your tax bracket.

If you held and sold crypto for more than one year, then it would be taxed as a long-term capital gain. Those capital gains tax rates are 0, 15, or 20 percent depending on your taxable income that year.

If you happen to lose money on your investment, you can use it against your other gains and income. There is a $3,000 yearly limit, but you can carry the rest over to subsequent years when you file.

This is a NET capital loss of the $3,000 limit. For example, if you had $10,000 in other capital gains and $15,000 in losses from crypto, youd actually be able to claim $13,000 in capital losses on your return. By netting $10,000 of your loss against your capital gains, your remaining loss ends up being $5,000. You could deduct the yearly maximum of $3,000, and the remaining $2,000 would be carried forward for you to deduct next year.

If you sold any Bitcoin last year, we also have a handy Bitcoin tax calculator to help you estimate your cryptocurrency taxes.

Why Can’t Coinbase Pro Generate My Tax Forms

Many cryptocurrency investors use additional exchanges, wallets, and platforms outside of Coinbase Pro. Perhaps you also trade on Coinbase or earn interest from BlockFi. The trouble with Coinbase Pro’s reporting is that it only extends as far as the Coinbase Pro platform. If you use additional cryptocurrency wallets, exchanges, DeFi protocols, or other platforms outside of Coinbase Pro, Coinbase Pro can’t provide complete gains, losses, and income tax information.

Recommended Reading: Long-term Hotel Stay Tax Exempt