How To Collect Sales Tax In Texas

If the seller has an in state location in the state of Texas, they are legally required to collect sales tax at the rate of the their own location, where the sale was made, as Texas is an origin based sales tax state.If the seller’s location is out of state, and the seller has tax nexus, then the state of Texas becomes an destination based state, and must collect sales tax at the local rate of the buyer.

Texas Sales Tax Deadlines

Once a businesss sales tax application has been approved, it will receive a letter with instructions on how often it must file a sales tax return. Returns may be due monthly, quarterly, or yearly.

Monthly Filers: Due on the 20th of the following month.

| Period |

|---|

Annual Filers: Due on January 20 for the previous years taxes.

If a due date falls on a Saturday, Sunday, or legal holiday, the deadline is extended until the next business day.

What Is Taxable In Texas

Tangible personal property sold within the state of Texas or to residents in Texas is subject to sales tax.

In addition, certain services are also taxable. At the time of this writing, these services are:

- Amusement Services

- Cable And Satellite Television Services

- Motor Vehicle Parking And Storage Services

- Nonresidential Real Property Repair, Restoration Or Remodeling Services

- Personal Property Maintenance, Remodeling Or Repair Services

- Personal Services

- Utility Transmission And Distribution Services

- Taxable Labor Photographers, Draftsmen, Artists, Tailors, Etc.

for information that outlines Texass taxable services with complete descriptions.

You May Like: Free Tax Filing H& r Block

Misplacing A Sales Tax Exemption/resale Certificate

Texas sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Texas Comptroller of Public Accounts may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Filing When There Are No Sales

Once you have a Texas seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.Failure to submit a zero return can result in penalties and interest charges.

Don’t Miss: When Is Taxes Due 2021

Sales Tax Collection Discounts In Texas

Texas allows merchants to keep a small percentage of the sales tax they collect as a collection discount, which serves as compensation for the work required to comply with the Texas sales tax regulations

The collection discount is 0.5% of the tax that is due, in addition to 1.25% of any prepaid tax, although this does not apply to any permit holders.

Learn About Paying With Web File

You can pay directly from your bank account when you Web File your sales tax return, or make payments in advance of filing. Both options conveniently save your bank account information for future use.

If you pay when you Web File, you can still schedule the payment in advanceas long as you’re filing before the due date.

To help you remit the correct amount, organize your sales data with our Sales Tax Web File worksheets.

Also Check: Illinois State Sales Tax Rate 2021

Texas Sales Tax Nexus

Sales tax nexus is a term that means that a retailer has a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or another agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.

Who Is Responsible For Use Tax

Texas sellers are required to collect and remit sales and use tax to the Comptrollers office on their sales of taxable items or obtain a resale or exemption certificate in lieu of collecting the tax.

A Texas purchaser owes state and local use tax if they buy taxable goods and services that are stored, used or consumed in Texas from a seller who does not charge Texas sales tax. If the seller does not have a permit or fails to charge sales and use tax, the purchaser must pay the use tax directly to our office unless an exemption applies.

For example, if you buy a shirt through an online auction from a seller in Ohio who does not charge Texas tax, or if a New York electronics store sells you a camera through its website and does not charge Texas tax, you owe Texas use tax on the sales price of the item.

Items bought in another country and used in Texas are also subject to Texas use tax. For example, if you buy taxable items in Mexico that you bring back to Texas, you owe Texas use tax on the purchase price of those items.

You must pay state and local use tax if you have the item delivered to, or use the item in, an area that imposes a local tax. If you buy an item from a seller located in a part of Texas with no local taxes, you will only pay state sales tax on that purchase. See Publication 94-105, Local Sales and Use Tax Collection A Guide for Sellers, for additional information regarding local use tax.

Read Also: What Happens If You Can T Pay Your Taxes

When To File And Pay

You must file a sales tax return either monthly, quarterly, or yearly. The deadlines are as follows:MonthlyFor monthly filers, reports are due on the 20th of the month following the reporting month. For example, the April sales tax report is due May 20.QuarterlyFor quarterly filers, reports are due on the 20th of the month following the reporting period.

YearlyFor yearly filers, reports for the previous year are due on January 20.

Note: Didnât make any sales in Texas during your reporting period? You should still report that. This is typically called a âNil declarationâ and it follows the exact same process as a normal return. Texas also allows you to file a nil declaration by phone using Telefile.

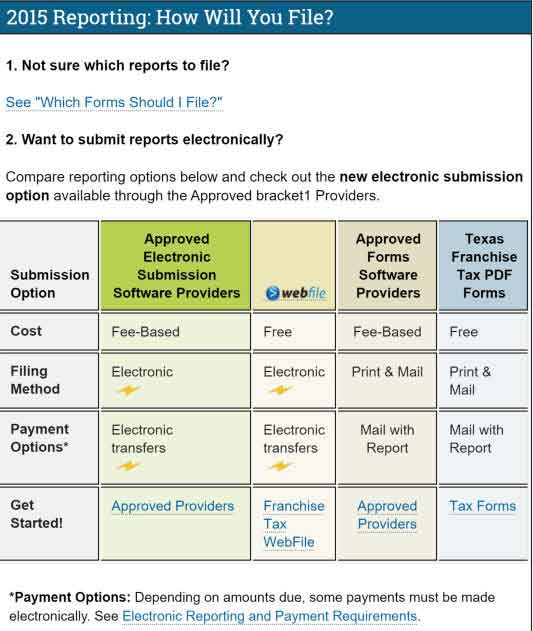

Filing Your Texas Sales Tax Returns Online

Texas supports electronic filing of sales tax returns, which is often much faster than filing via mail.

Texas allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official Texas WebFile website, which can be found here

Please note that if you file your Texas sales taxes by mail, it may take significantly longer to process your returns and payments.

Simplify Texas sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Recommended Reading: What Percentage Is Self Employment Tax

Respond To A Department Notice

If you receive a bill or notice, respond online. It’s the easiest, fastest way. We’ll walk you through the process.

Note: If your refund status says we sent you a letter requesting additional information, see Respond to a letter for more information and to review our checklists of acceptable proof.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Missouri sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Read Also: How Long Do Taxes Take To Come

Requirements For Reporting And Paying Texas Sales And Use Tax

Select the amount of taxes you paid in the preceding state fiscal year to find the reporting and payment methods to use.

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Texas: Does My Webfile Number Begin With Rt Or Xt

Texas assigns users two WebFile numbers: one for Sales Tax and one for Franchise Tax.

- The WebFile number for Sales Tax begins with RT.

- The WebFile number for Franchise Tax begins with XT.

Because AutoFile is designed to file your Sales Tax Returns, you’ll need to make sure the WebFile number you enter in your AutoFile enrollment form for Texas begins with RT.

- If you have questions regarding your sales tax WebFile number, the Texas Comptroller’s Office has information here about locating your WebFile number.

- You can also reach them by phone at 800-252-5555.

You May Like: Exempt From Federal Income Tax

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

How To File A Texas Sales And Use Tax Return

This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow’s content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 18,151 times.Learn more…

If you own a business in Texas that sells products or provides taxable services, you must collect state and local income tax from your customers and pay that money to the Texas Comptroller’s Office on either a monthly, quarterly, or yearly basis. The state sales and use tax is 6.25 percent, but cities and counties can add up to 2.00 percent on top of that, for a maximum total rate of 8.25 percent. Those additional local taxes vary greatly throughout the state.XResearch source

Recommended Reading: How To Pay Taxes On Stocks

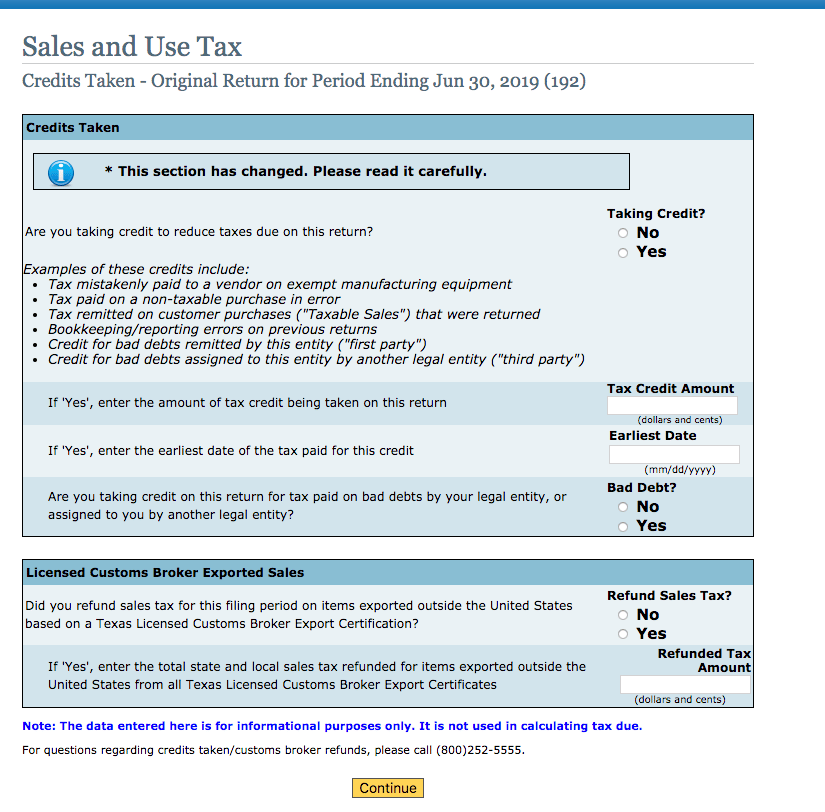

Sales And Use Tax Online Filing And Payments

Quarterly Sales and Use Tax Returns are due before 11:59 p.m. of the 20th day of the month after the end of the filing period. If the due date falls on a weekend or legal holiday, the return and payment are due on the following business day.

You do not have to wait until the due date to file. You can file your return early for the current quarter and schedule a future payment on or before the return due date.

If you do wait until the filing due date, you may experience high volume related errors with the online filing system. These issues are usually intermittent, but may impact your ability to file timely. Alternately, you may use the EZ Telefile System by calling – , and select option 1.

Plan ahead to ensure timely filing and payment.

How To Register For A Texas Sellers Permit

You can register for a Texas Business Tax License online through the Texas Comptroller of Public Accounts. To apply, youll need to provide the Texas Comptroller with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

You May Like: Tax Preparer Santa Ana Ca

Sourcing Sales Tax In Texas: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale . Texas does a little of each.The origin address is used first. However, if the local tax rate from the origin address is less than 2 percent, the destination address is used to apply additional local tax up to the state-mandated 2-percent limit.For example:

- If an order is placed in person at a place of business in Texas, the rate is based on where the order is placed

- If an order is fulfilled at a sellers place of business in Texas, the rate is based on where the order is fulfilled

- If an order isnt fulfilled at a sellers place of business in Texas, but is received at a sellers place of business in Texas, the rate is based on where the order is received

- If an order isnt received or fulfilled at a sellers place of business in Texas, but is fulfilled at a Texas location, the rate is based on where the order is shipped or delivered

- If the order is received, fulfilled, and delivered from a location outside of Texas, and the seller doesnt have nexus with Texas, no tax is due

For additional information, see Local Sales and Use Tax Collection A Guide for Sellers.

Have You Heard About The Homeowner Tax Rebate Credit

The homeowner tax rebate credit is a one-year program providing direct property tax relief to eligible homeowners in 2022.

If you’re a homeowner who qualifies, we’ll automatically send you a check for the amount of the credit. Your amount will depend on where your home is located, how much your income is, and whether you receive Enhanced or Basic STAR.

You May Like: Cheap Tax Software For Tax Preparers

When You Need To Collect Texas Sales Tax

In Texas, sales tax is collected on the sale, lease, or rental of tangible goods and some services. The tax is collected by the seller and remitted to state and local tax authorities. The seller acts as a de facto tax collector. However, how does a seller know when they are required to collect sales tax in Texas?

The 1992 Quill Corp. v. North Dakota ruling held that a state could only require a company to collect, file, and remit sales tax if the seller had a substantial physical presence in the state. For many online sellers, this meant they did not have to collect tax on sales to consumers located in Texas. This, however, was overturned in 2018 with the South Dakota v. Wayfair, Inc. ruling by the Supreme Court.A lot has changed with regards to sales tax lawsTo help you determine whether you need to collect sales tax in Texas, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

New System Login Requirements

You will need to set up a new User ID and password. Create your new TX Sales Tax WebFile access quickly and easily today to ensure your access to the new system is ready and waiting before the Jan. 20 due date for Texas sales tax.

The WebFile screens also have an updated look, but the filing process is essentially the same.

Read Also: Do You Have To Pay Taxes On Inheritance

How To Register For Sales Tax In Texas

Remote sellers register for sales tax in Texas according to where you are based. US businesses can register via eSystems, an online tax portal. This portal is also where youâll file and pay your tax returns. More on that later!International businesses must register by filling out a form and emailing it to the Texas Comptroller office. Youâll find more information below.

Taxable And Exempt Shipping Charges

Texas sales tax may apply to charges for shipping, delivery, freight, and postage. Charges for handling are generally taxable. The general rule of thumb in Texas is that if the sale is taxable, transportation and related delivery charges incurred both before and after the sale are taxable, even if stated separately from the sales price. If the sale is exempt, related delivery charges are generally exempt.If a shipment contains both taxable and exempt items, related delivery charges may be either taxable or exempt, depending on the ratio of exempt and taxable goods.Tax may also apply to drop shipping scenarios. If you use drop shipping to deliver items to customers in Texas, you may be responsible for collecting and reporting tax. However, if you pay a third party to deliver or ship items at the customers request, separately stated charges are generally not taxable.The Texas Comptroller of Public Accounts recommends keeping clear invoices and records for all transactions. Records must reflect the total gross receipts from all sales, rentals, leases, taxable services, and taxable labor, as well as the total purchases of taxable items. Additional records must be kept to validate deductions, exclusions, or exemptions.There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in Texas and sales tax should be taken directly to a tax professional familiar with Texas tax laws.

Don’t Miss: Mass Tax Connect Phone Number