What Are Property Taxes

Property taxes, or real estate taxes, are paid by a real estate owner to county or local tax authorities. The amount is based on the assessed value of your home and vary depending on your states property tax rate. Most U.S. homeowners have to pay these fees, usually on a monthly basis, in combination with their mortgage payments. If you pay off your loan, you receive a bill for the tax from local government occasionally during the year.

The money used for the property tax goes toward the community. It supports infrastructure improvements, public services and local public schooling.

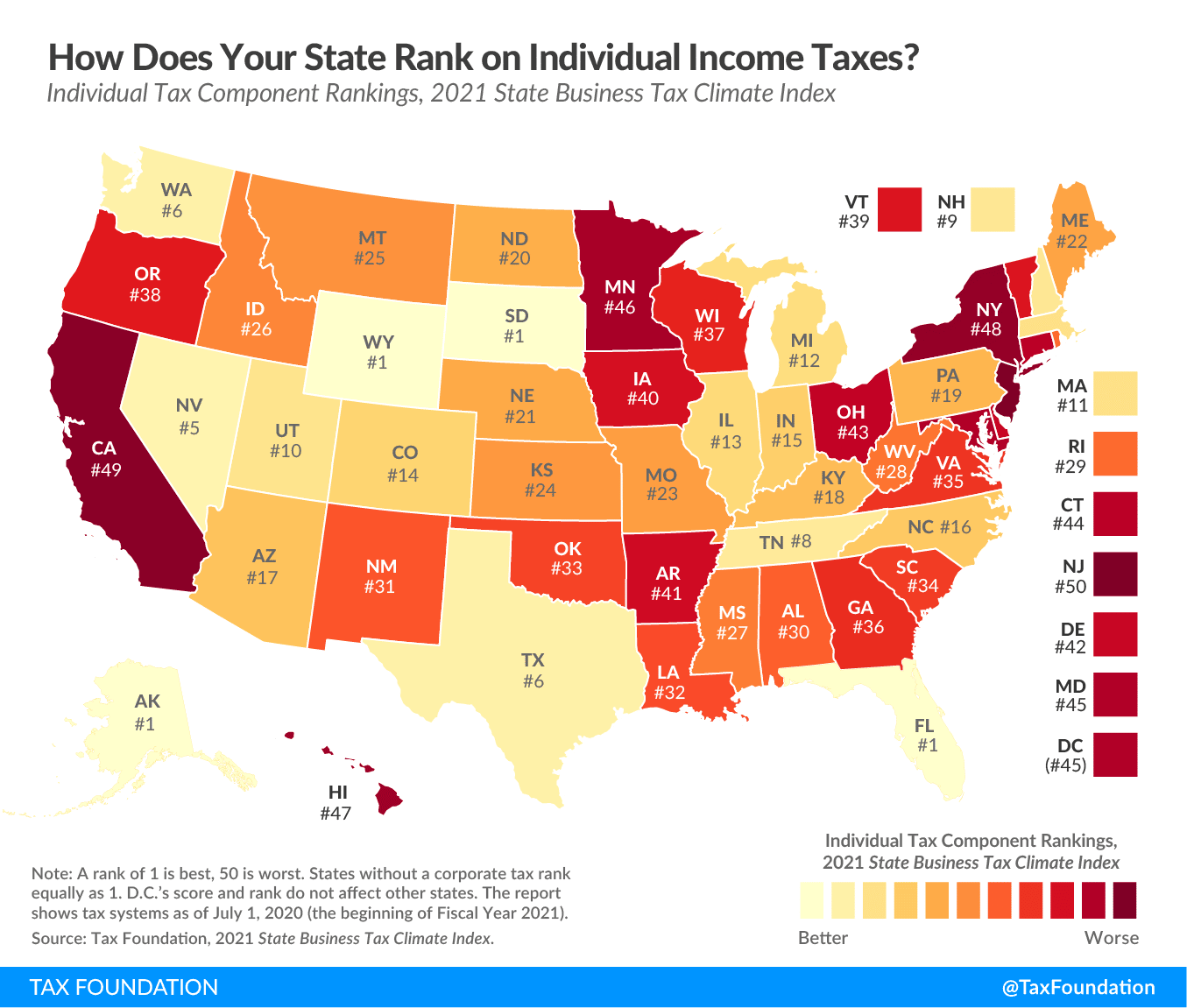

Top Income Tax Rates By State

Below, you’ll find the top 10 states with the highest income tax rates.

| State | |

|---|---|

| Wisconsin | 7.65% |

California tops the list with the highest income tax rates in the countryits highest tax rate is 12.3%, but it also implements an additional tax on those with income of $1 million or more, which makes its highest actual tax rate 13.3%. New Jersey and New York also implement this type of “millionaire’s tax.” Other states have a top tax rate, but not all states have the same number of income brackets leading up to the top rate. For example, Hawaii has a top tax rate of 11% and 12 income brackets, while Iowa has a top tax rate of 8.53% and nine income brackets. And of course, Washington, D.C. is not a state, but it has its own income tax rate.

Where Do You Pay Income Tax For Out

You should always expect to file income taxes in the state where you live. If you cross state lines for your job, you may or may not have to file taxes in another state, too. Some states have agreements that allow workers to only file taxes where they live, regardless of where they work. Check with a tax professional to learn how state laws may apply to your situation.

Also Check: What States Have No Income Taxes

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Explore additional ways to lower your tax burden in our new video series.

Federal Income Tax: 1099 Employees

Independent contractors, unlike W-2 employees, will not have any federal tax deducted from their pay. This means that because they are not considered employees, they are responsible for their own federal payroll taxes .

Both 1099 workers and W-2 employees must pay FICA taxes for Social Security and Medicare. But, whereas W-2 employees split the combined FICA tax rate of 15.3% with their employers, 1099 workers are responsible for the entire amount.

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Recommended Reading: Harris County Tax Assessor Office

How Much A Typical Taxpayer Actually Pays

A much more sophisticated measure of a state’s tax burden is to look at how much a typical taxpayer actually pays. The following chart measures the state and local tax burden for a household earning the median income in the United States.

What Is “Median Income”?

The “median income” is the income level at which half of the United States households earn more, and half earn less.

The median income in the United States was $82,852 in 2020. This chart also assumes the household owns a home worth $349,400 and has one dependent child.

|

State and Local Tax Burden for Median Income State Households |

|

|

State |

|

|

4.0% |

Based on this chart, New Hampshire taxpayers with median incomes pay 14.1% of their income in state and local taxes. Massachusetts taxpayers with the same median incomes pay lessâ11.8%. It’s likely that taxes take up more of a median income household’s income in New Hampshire because it doesn’t have a state income tax on wages graduated by income. Instead, it relies more on property taxes, which aren’t based on a taxpayer’s income.

So, if you’re a middle-income person, you’ll pay a smaller portion of your income in state and local tax in Massachusetts than in New Hampshire. The fact that New Hampshire doesn’t have an income tax on wages isn’t good for the average taxpayer.

Low Taxes Or Just Regressive Taxes

This report identifies the most regressive state and local tax systems and the policy choices that drive that unfairness. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as low-tax states, often with an emphasis on their lack of an income tax. But this raises the question: low tax for whom?

No-income-tax states like Washington, Texas, and Florida do, in fact, have average to low taxes overall. However, they are far from low-tax for poor families. In fact, these states disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families.

FIGURE 10

Figure 10 shows the 10 states that tax poor families the most. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Washingtons poor families pay 17.8 percent of their income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 9.2 percent and 10.1 percent, respectively, of their incomes in state and local taxes far less than in Washington.

Recommended Reading: Pay My Taxes To Irs

Effective Income Tax Rates

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income. Only the first $118,500 of someone’s income is subject to social insurance taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.

| Effective federal tax rates and average incomes for 2010 |

|---|

| Quintile |

States With No Individual Income Tax

Nine U.S. states do not level a broad-based individual income tax. Some of these do tax certain forms of personal income:

You May Like: Due Date To File Taxes 2022

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2020 to 2021, as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2021.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average.

Of the states with an E grade, two out of three had population declines in 2021. Of the nine states with a D grade, only two New Hampshire and Vermont had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Retirement Savings And Fringe Benefit Plans

Employers get a deduction for amounts contributed to a qualified employee retirement plan or benefit plan. The employee does not recognize income with respect to the plan until he or she receives a distribution from the plan. The plan itself is organized as a trust and is considered a separate entity. For the plan to qualify for tax exemption, and for the employer to get a deduction, the plan must meet minimum participation, vesting, funding, and operational standards.

Examples of qualified plans include:

Employees or former employees are generally taxed on distributions from retirement or stock plans. Employees are not taxed on distributions from health insurance plans to pay for medical expenses. Cafeteria plans allow employees to choose among benefits , and distributions to pay those expenses are not taxable.

In addition, individuals may make contributions to Individual Retirement Accounts . Those not currently covered by other retirement plans may claim a deduction for contributions to certain types of IRAs. Income earned within an IRA is not taxed until the individual withdraws it.

| Ordinary income rate |

|---|

- * Capital gains up to $250,000 on real estate used as primary residence are exempt

Don’t Miss: Why Am I Paying Medicare Tax

Which Are The Highest Find Out Here

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

One of the biggest tax bills that most people pay is the federal income tax calculated on the Internal Revenue Service Form 1040 in April of each calendar year. Three other major taxes come from your state or locality: state income taxes, sales taxes, and property taxes. The way that each type of tax is calculated is complicated factors such as your income level, marital status, and county of residence affect your tax rates.

Simple, apples-to-apples comparisons of how much total tax youll pay living in one state versus another are impossible. And since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you cant simply add up the average rates in each state and rank them from lowest to highest.

However, if youre trying to choose where to live or to locate your businessand taxes are a factor in your decisionthen the tables below can give you a big picture to use as the starting point for more research on how taxes in each state would impact your unique financial situation.

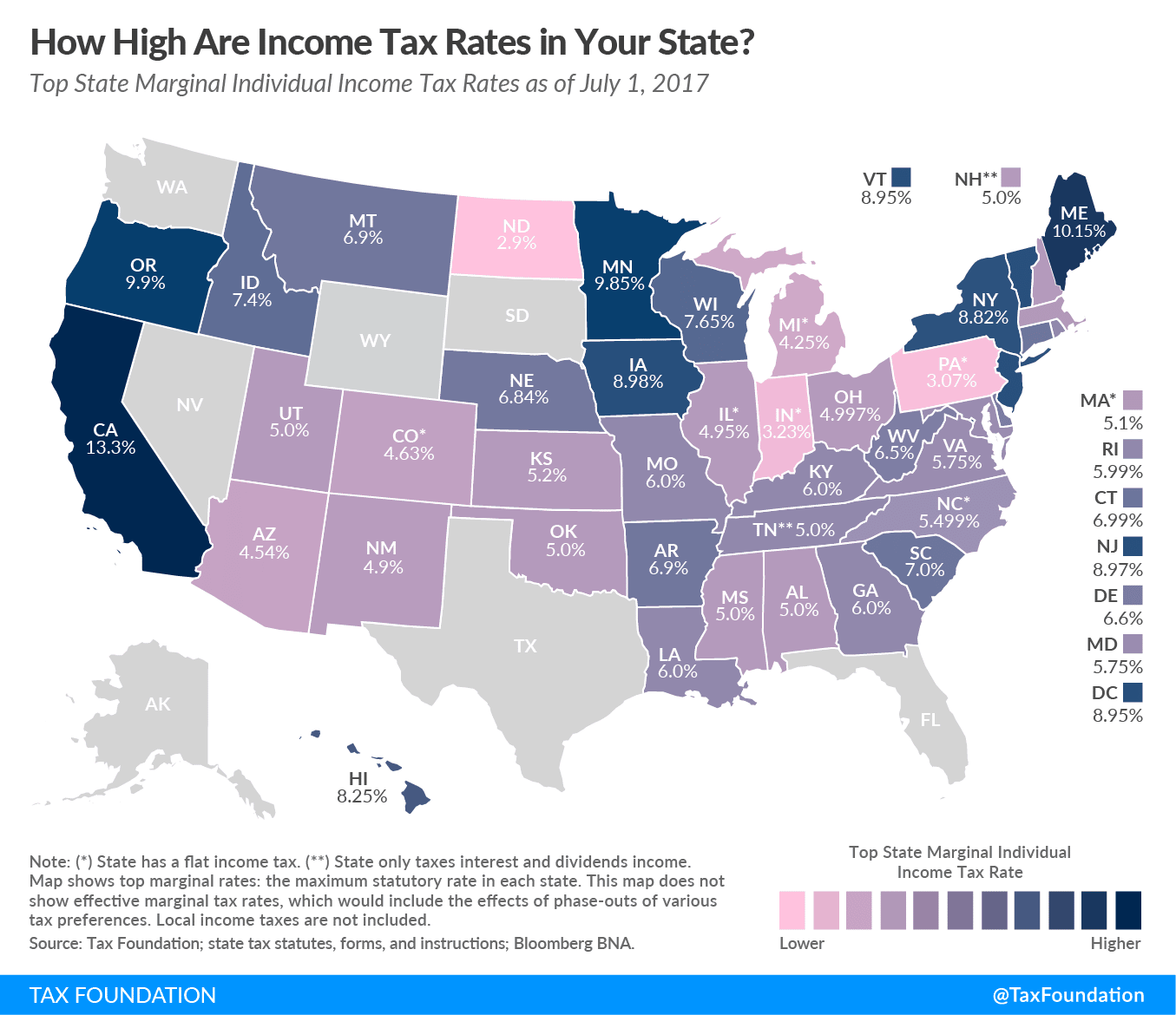

Income Tax Rates Run From 0% To More Than 13%

Halfpoint / Getty Images

Location is everything if you want to save a few income tax dollars. Overall, state tax rates range from 0% to more than 13%.

Learn which states have the highest tax rates, no taxes, and flat taxes and see a complete list of tax rates for every state in the union.

Don’t Miss: How Much Taxes Deducted From Paycheck Tn

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

|

Key Takeaways The states with the highest income tax for 2021 include California 13.3%, Hawaii 11%, New Jersey 10.75%, Oregon 9.9%, and Minnesota 9.85%. Eight states have no personal income tax, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. The states with the highest total sales taxes include Tennessee 9.55%, Louisiana 9.52%, Arkansas 9.51%, Washington 9.23%, and Alabama 9.22%. The states with the lowest total sales taxes are Alaska 1.76%, Oregon 0%, Delaware 0%, Montana 0%, and New Hampshire 0%. |

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

Also Check: Rental Property Income Tax Calculator

Undermining Progressivity With Tax Breaks For Wealthy Taxpayers

In contrast to states that improve tax fairness with tax credits for low-income families, more than a dozen states currently allow substantial tax breaks for the wealthy that undermine tax progressivity. Two of the most regressive state income tax loopholes are capital gains tax breaks and deductions for federal income taxes paid .

In combination with a flat rate structure, these tax breaks can create an odd and unfair situation where the highest income taxpayers devote a lower percentage of their income to income taxes than their middle-income neighbors.

For example, Alabama allows a deduction for federal income taxes. Although Alabamas income tax is essentially flat, the federal income tax is still progressive. So Alabamas deduction for federal income taxes disproportionately benefits the states wealthiest taxpayers. As a result, effective marginal income tax rates in Alabama actually decline at the states highest income levels. Despite the 5 percent top tax rate, the effective income tax rate on the very wealthiest taxpayers is actually less than 3 percent. Among the six states that allow a deduction for federal taxes, three allow a full deduction for federal taxes, including Alabama, while the other three have a partial deduction.

State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $25,295 and spends annually an amount equal to the spending of a household earning the median U.S. income.

Read Also: How To File Taxes Yourself

Effects On Income Inequality

According to the CBO, U.S. federal tax policies substantially reduce income inequality measured after taxes. Taxes became less progressive measured from 1979 to 2011. The tax policies of the mid-1980s were the least progressive period since 1979. Government transfer payments contributed more to reducing inequality than taxes.