Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

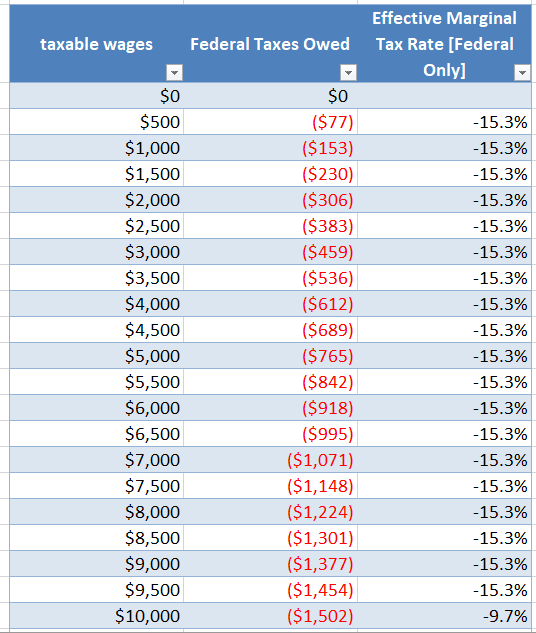

Social Security Tax Withholding Calculation:

As mentioned above, a Social Security tax rate of 6.2% is levied on each employee while you also pay a matching 6.2% for each employee, making it to be 12.4% in total.

To calculate Social Security withholding, multiply your employees gross pay for the current pay period by the current Social Security tax rate .

Don’t Miss: What Are State Income Taxes

Lets Review Our Example Using The 2019 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $178.96 using the old W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,744.18.

Additional Medicare Tax Withholding

The employee tax rate for additional Medicare taxis an employee only tax that begins when wagespaid to an employee exceed a certain amount.

Both the tax rate and the wage threshold are detailedin IRS Publication 15.

As an employer you are responsiblefor withholding additional Medicare tax when an employeemeets this threshold,but you do not have an employer matching share to pay.

Read Also: Doordash Payable Account

Don’t Miss: How Do I File Back Taxes

Run Your Own Payroll In Minutes

Get Started Now or Schedule a 15 Minute Demo

Get Started Now or Schedule a 15 Minute Demo

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.

Get Started Now or Schedule a 15 Minute Demo

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.

Think Out Of The Box: Outsource Your Payroll Tax

The above is the most comprehensive way to understand how to calculate the payroll taxes under each Act. Having said that, if you are still finding payroll to be a hard nut to crack, you can always outsource this function to a payroll management service provider. Monily has helped thousands of businesses over the years manage their payrolls conveniently and has guided them on how to calculate the payroll taxes. Our accounting experts and financial advisors do the nitpicky and pesky calculations for all startups, small and medium-sized businesses. What may appear complex to you is a breeze for our payroll experts.

Schedule a free consultation today and let our experts handle this daunting function of payroll tax calculation for you.

Recommended Reading: Property Tax Vs Tax Assessment

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

You May Like: Which States Have No Income Tax

California State Payroll Taxes

Now that were done with federal income taxes, lets tackle California state taxes. The State of California wins for the highest top marginal income tax in the country. Its a progressive income tax, meaning the more money your employees make, the higher the income tax. The following graph gives insight into the varied tax rates in place for single filers.

More information can be found on the California Franchise Tax Board website.

The Golden State has four state payroll taxes administered by the Employment Development Department : 1) Unemployment Insurance, 2) Employment Training Tax, 3) State Disability Tax, and 4) Personal Income Tax. Youre responsible for paying half of those taxes, while the other half should be withheld from each employees paycheck. Details and rates can be found on the EDD website.

- What You Pay For:

- Unemployment Insurance is issued by the U.S. Department of Labor. UI provides temporary payments to those who are unemployed against their own capabilities. Employers pay up to 6.2% on the first $7,000 in wages paid to each employee in a calendar year. New employers pay 3.4% for the first two to three years. Each December, you will be notified of your new rate.

- Employment Training Tax, also known as funding for training. You are responsible for paying 0.1% of the first $7,000 of wages per employee a year. This ones relatively cheap, maxing out at $7 per employee a year.

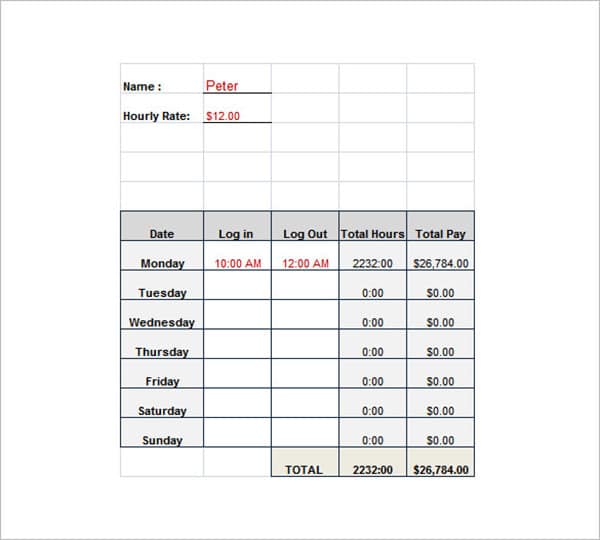

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

You May Like: State Of California Estimated Taxes

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. Each period has a specific payment due date. If you dont pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.

If a payment is mailed, the date of the U.S. postmark is the date of payment. If the due date for an estimated tax payment falls on a Saturday, Sunday, or legal holiday, the payment will be on time if you make it on the next day that isnt a Saturday, Sunday or holiday.

Lets Review Our Example Using The 2020 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

Recommended Reading: Best States To Retire In 2021 For Taxes

Table 81 Rates Income Thresholds And Constants For 2023

| Province or territory |

|---|

| 0.480 |

For information on 2022 federal personal amounts, see the form TD1, Personal Tax Credits Return and the form TD1X, Commission Income and Expenses for Payroll Tax Deductions. For information on 2022 provincial or territorial personal amounts, see the respective form TD1AB, TD1BC, TD1MB, TD1NB, TD1NL, TD1NS, TD1NT, TD1NU, TD1ON, TD1PE, TD1SK, or TD1YT. For information on QC amounts, refer to Revenu Quebec.

* Alberta resumed indexing as of 2022 the basic personal amount for 2022 has been updated retroactively** Basic personal amount for New Brunswick has been updated as per the announcement made by the province in 2022

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

Also Check: Sales Tax And Use Texas

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

The Great Depression And World War Ii

During the Great Depression, the government increased personal and corporate income taxes to help balance the budget. The government also introduced new taxes, such as on retail sales.

World War II led to even more changes in the taxation system. The government needed to finance the war effort by increasing income taxes and introducing new taxes. For example, aninheritance taxwas created.

Also Check: Why Did My Property Taxes Go Up In 2021

Do I Have To Withhold Deductions If I Pay Myself A Salary

If the business is a sole proprietorship or partnership, deductions will not be sent to the CRA via the payroll account. For these businesses, payments are made when the T1 income tax and benefit return is filed, unless the sole proprietor or partner is required to pay by instalments.

For entrepreneurs employed by their incorporated business, their salary will be treated as employment income and deductions will be required. If the entrepreneur controls more than 40% of the common shares , he or she is exempt from Employment Insurance premiums and will not be entitled to Employment Insurance benefits. However, there are Employment Insurance special benefits for self-employed people.

Who Does Not Have To Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck.

You dont have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident alien for the whole year

- Your prior tax year covered a 12-month period

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

Don’t Miss: New Jersey State Sales Tax

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

Recommended Reading: Irs Estimated Tax Payment Dates

How Is Pay Frequency Used To Calculate Payroll

For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.For example, let’s look at a salaried employee who is paid $52,000 per year:

- If this employee’s pay frequency is weekly the calculation is: $52,000 / 52 payrolls = $1,000 gross pay

- If this employee’s pay frequency is semi-monthly the calculation is: $52,000 / 24 payrolls = $2,166.67 gross pay

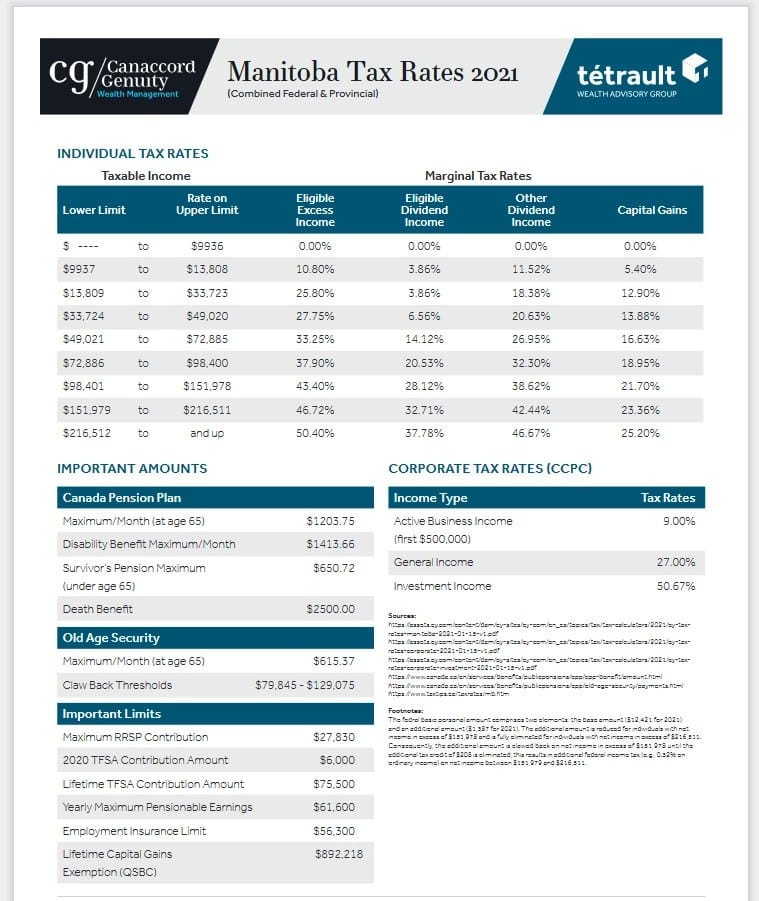

What Is Quebec’s Marginal Tax Rate

Quebec marginal tax rate is another term for tax brackets. Tax in Quebec is determined by the taxable income amount:

- $45,105 or less is taxed at 15%,

- more than $45,105 but not more than $90,200 is taxed at 20%

- more than $90,200 but not more than $109,755 is taxed at 24%

- Amounts more than $109,755 is taxed at 25.75%.

Also Check: Federal Tax Rate On Capital Gains

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Other Deductions That Reduce Gross Pay

Employers are allowed to provide benefits to their employees that are funded by pre-tax payroll deductions, including:

- Retirement plan contributions. This can include a 401 plan.

- 403 plan contributions for nonprofit or government employees.

- Flexible spending account contributions, a voluntary program that provides reimbursement for medical expenses.

- Health savings account contributions, which are similar to flexible spending accounts. The difference is that the money in the account does not roll over between fiscal years.

If you need help with determining how to calculate payroll taxes, you can post your legal need on UpCounsels marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Recommended Reading: Irs Mail Address Tax Return

Formula To Calculate Annual Taxable Income

A = Annual taxable income = HD F1 If the result is negative, T = L.

Only for employees paid by commission:

A = I1 F* F2* F5A U1* HD F1 E If the result is negative, T = L. * Estimated deduction amounts for the year. For registered retirement savings plan contributions included in F, you will need to find out from your employee paid by commission the estimated or expected annual deduction. We recommend that you caution employees not to exceed their RRSP contribution limit for the year.

P = The number of pay periods in the year:

Weekly

P = 12P = 10, 13, 22, or any other number of pay periods for the year

F2 = In situations where a garnishment or a similar order of a court or competent tribunal states that the alimony or maintenance payment cannot be more than a certain percentage of the employees net salary , more calculations may be required, as follows:

F1 = If the F1 amount is implemented after the first pay period in the year, F1 must be adjusted using the following formula: / PR

Only for employees in Quebec: F5Q = C ×