Here Are A Few Ways Taxpayers Can File For An Extension

- File Extension Form 4868 electronically. Taxpayers, or their preparers, can use IRS Free File to e-file a free extension request. The form is available on IRS.gov and through tax software packages. The IRS must receive an electronically filed extension request by 11:59 p.m., Wednesday, April 15, 2020.

- Electronic payment options. The IRS will automatically process an extension of time to file when taxpayers pay all or part of their tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or a . This way taxpayers won’t have to file form 4868 and will receive a confirmation number for their records.

- Mail Form 4868. Taxpayers can request an extension using the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return by mailing the form to the address in the instructions.

The IRS offers payment options for taxpayers who can’t pay all the tax they owe. In most cases, they can apply for an installment agreement with the Online Payment Agreement application on IRS.gov. They may also file Form 9465, Installment Agreement Request. The IRS will work with taxpayers who can’t make payments.

Taxpayers must request the automatic extension by the due date for their return. They can file their return any time before the six-month extension period ends on October 15, 2020. The taxpayer enters any payment they made related to the extension of time to file on Schedule 3 Form 1040 or 1040-SR, line 10.

More Time To File And Pay

If you wont be able to file by the original May 1 deadline, dont worry. Everyone has an automatic 6-month filing extension in Virginia, which moves the filing deadline from May 1 to November 1 for most taxpayers .

In addition, as part of the state’s COVID-19 tax relief actions, if you owe taxes, you have until June 1, 2020 to pay without any penalties or interest.

This also applies to individual extension payments for Taxable Year 2019 as well as the first estimated income tax payments for Taxable Year 2020.

What Happens When You E

Your Personal tax extension Form 4868 gets reviewed for any errors and is transmitted securely through our IRS-authorized, e-filing network.

Depending on the filing capacity, the IRS could get back with you within the hour. Our email notifications will keep you updated on your filing status. If your gets rejected, we immediately point out the issue and allow you to correct any mistakes and retransmit for free. No worries, our forms are simple for quick approvals!

Also Check: When Am I Getting My Tax Return

What If I Dont File By October 17

People who fail to file their return by the extended tax deadline will face harsher penalties. The IRS charges 5% of the unpaid taxes for each month that a tax return is late or 10 times more than the underpayment penalty. It caps the penalty at 25% of your unpaid taxes. The tax agency also charges interest on the penalty.

Also Check: Federal Small Business Tax Rate

You Filed An Amended Return

If you filed an amended return using Form 1040-X, you might still have some good news coming your way if you overpaid or are owed credits for the year youre amending but it might take a while.

As of Sept. 24, the IRS was still facing a backlog of 1.5 million amended returns. Theyre processed in the order theyre received, but the IRS warns that it could take up to 20 weeks to get to them.

Recommended Reading: How To Get Old Tax Returns

Volunteer Income Tax Assistance

The IRSs Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if theres a community-based site staffed by IRS-trained and certified volunteers still open near them.

Also Check: Do You Have To Pay Taxes On The Stimulus Check

I Filed An Extension But The Irs Sent Me A Notice Saying I Didn’t

If the IRS sends you a notice assessing the failure to file penalty, youll need to respond with the information you have and ask it to remove the penalty. Depending on how you requested the extension, you should have documentation, such as the confirmation receipt for an electronically filed extension, or proof of mailing .

If you didnt file an extension in time, but something happened that you believe amounts to reasonable cause for not filing, you can ask the IRS to abate the penalty. Youll need to write a statement describing what kept you from filing on time.

Read Also: What’s The Deadline For Filing Taxes

How Will This Affect Me

The IRS will send you a letter as soon as possible if it doesnt approve your extension request.

Penalties

The IRS can assess a failure to file penalty for filing late. Filing for an extension may help you avoid this penalty. Generally, though, if you dont also send a payment of your estimated tax, youll be assessed a failure to pay penalty. If you want to appeal the penalty, follow the directions on the notice, or use IRS.govs Appeals Online Self-Help Tools.

I filed an extension but the IRS sent me a notice saying I didnt

If the IRS sends you a notice assessing the failure to file penalty, youll need to respond with the information you have and ask it to remove the penalty. Depending on how you requested the extension, you should have documentation, such as the confirmation receipt for an electronically filed extension, or proof of mailing .

If you didnt file an extension in time, but something happened that you believe amounts to reasonable cause for not filing, you can ask the IRS to abate the penalty. Youll need to write a statement describing what kept you from filing on time.

Contribute To A Sep Ira

Self-employed individuals and small business owners who wish to save money with an easy and affordable retirement plan frequently use a Simplified Employee Pension IRA, or SEP IRA. A SEP IRA actually allows you to save more for retirement than a 401 plan offered by your employer. You may deduct up to 25% of your salary for 2022, or $61,000, whichever is less.

As a result, you may save more for retirement using a SEP IRA than you could with a regular or Roth IRA. Keep in mind that the contribution maximum for both regular and Roth IRAs in 2022 is $6,000 .

Recommended Reading: How Can Tax Identity Theft Occur

Are Permanent Extensions Available

Yes, permanent extensions are available. Permanent extensions of more than 10 days beyond the due date require you pay the department an amount equal to the estimated tax liability for the reporting period you received the extension. This payment is credited to your account and applied to your liability when your permanent extension is cancelled.

The department will periodically review the amount you must pay, and may change it if it doesnt approximate the tax liability for the reporting period you received the extension.

Can I File 2021 If I Didnt File 2020

Some had wondered early on if they should wait to file 2021 federal income tax return until the 2020 moved through the IRS pipeline. No, the IRS said, you do not have to wait to have your 2020 return processed before you file the 2021 return. But you must take some extra steps if you want to file electronically.

Also Check: Irs Self Employment Tax Calculator

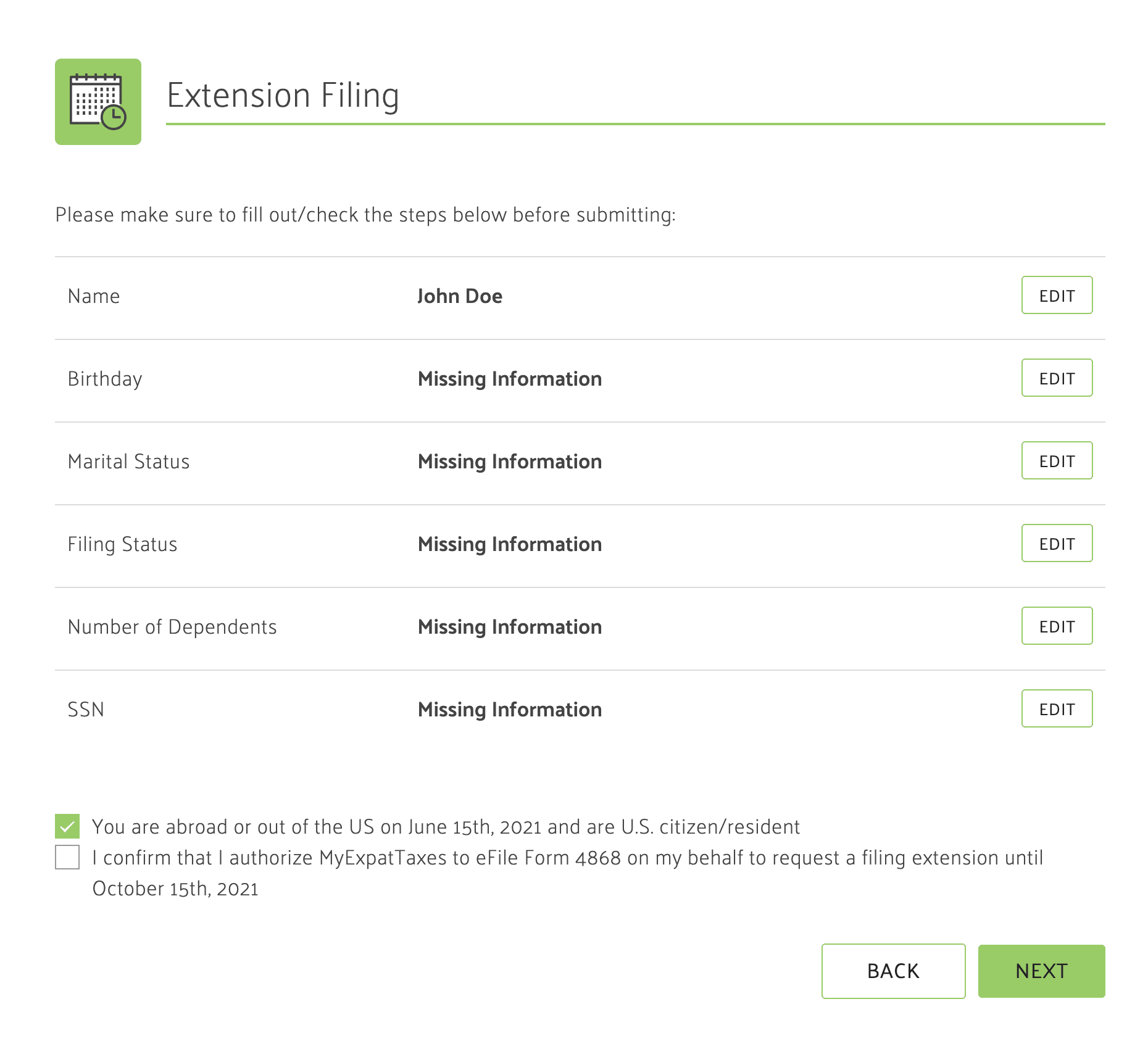

Taxpayers Outside The United States

U.S. citizens and resident aliens who live and work outside the U.S. and Puerto Rico have until June 15, 2022, to file their 2021 tax returns and pay any tax due.

The special June 15 deadline also applies to members of the military on duty outside the U.S. and Puerto Rico who do not qualify for the longer combat zone extension. Affected taxpayers should attach a statement to their return explaining which of these situations apply.

Though taxpayers abroad get more time to pay, interest currently at the rate of 4% per year, compounded daily applies to any payment received after this year’s April 18 deadline. For more information about the special tax rules for U.S. taxpayers abroad, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, on IRS.gov.

Filing A Business Tax Extension

The IRS posts the proper forms for filing an extension on its site, along with instructions and specifics about the regulations. IRS form 4868 can also be used by sole proprietorships that file a Schedule C with a personal return and single member limited liability companies .

Corporations, LLCs and more expansive businesses use IRS form 7004. As with an individual return, submitting this form is an automatic request for a six-month extension to file your businesss income taxes.

Federal tax extension forms can be submitted electronically. The IRS offers details on its site with online fillable forms, as well as details for . Many bookkeeping platforms integrate filing taxes into their platforms explore this option with your preferred tax filing or bookkeeping service.

Filing an official extension is not a way to avoid paying the taxes you owe. The expectation is to pay the anticipated amount of tax owed. The extension is for the sole purpose of providing the flexibility to file the remaining paperwork within the six-month extension.

There is no process for filing an additional extension beyond the one youre granted through October 15. A return can still be completed after this date, just expect to pay additional penalties. However, its a case where its definitely better late than never as to avoid additional penalties by further delaying the filing of a return. The IRS notes that a failure-to-file penalty is generally more than the failure-to-pay penalty.

Also Check: How Much In Taxes Do I Owe

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Ca Tax And Accounting Firm Serving Sacramento And Roseville

Cook CPA Group is a California tax and accounting firm serving businesses and individual taxpayers throughout the Sacramento and Roseville regions. Featuring skilled tax accountants and consultants, our accomplished team of financial professionals brings more than 20 years of combined experience to the clients we serve. If you or your business owes taxes to the state of California, has unfiled returns to catch up on, needs help resolving a tax controversy, or simply has questions about effective tax planning or FTB procedures, Cook CPA Group can provide detailed, step-by-step guidance for all your California and federal tax needs. To arrange a free consultation about our tax services in California, contact Cook CPA Group online, or call us today at 269-9282.

Consulting Services

Recommended Reading: Iowa State Tax Refund Status

Recommended Reading: Bexar County Tax Assessor Collector San Antonio Tx

The Tax Preparation Process

If you are filing your federal income tax return or filing an extension for the first time, you will need to gather various documents to ensure that your return is accurate. Having all of your tax information in one place can help you avoid making rookie mistakes and can lead to lower tax preparation fees. Heres a list of things you need to know and do during your tax preparation process:

The IRS also encourages you to file your taxes as early as possible to avoid penalties. Most people must file their taxes by May 1. You can also file early for an extension if youve already made a payment.

Read Also: Irs Tax Extension 2021 Form

Do Mortgage Companies Report To The Irs

The IRS does not take a taxpayers word for it and and will communicate with mortgage companies for information. Mortgage companies report the significant expenses related to deductions, reimbursements, and homeownership to the commission. Your lenders will report several different expenses to the IRS such as:

Dont Miss: How To Check On Status Of Tax Refund

Recommended Reading: California Used Car Sales Tax

What Happens If You Miss The Oct 15 Tax Deadline

Dont try to go past the Oct. 17 deadline which is technically Oct. 15 but delayed until Oct. 17 this year because the 15th is a Saturday.

If you filed an extension and you dont file your return, your penalty and interest calculations are grandfathered back to the original April 18 due date, Steber said.

At this point, documents should be in taxpayers hands, including W2, 1099s, K-1s for investments in partnerships. Double-check your numbers and information.

Any missing information or mismatched information on IRS systems can be expected to trigger trouble, including the delay of any refund.

Some tax filers figure they can come close to a number, say what they think they received in stimulus cash, and imagine that the IRS will fix it if necessary. But thats not a good bet, given all the problems the IRS has been facing.

Steber calls some tax troubles self-inflicted delay when tax filers dont provide exact numbers or information.

The IRS noted that taxpayers who are filing now want to avoid mistakes when claiming the earned income tax credit, the child and dependent care credit, the child tax credit and the recovery rebate credit.

In 2022, the message is clear: You need to be accurate, Steber said. There are no simple tax returns in the pandemic.

Contact Susan Tompor: . Follow her on Twitter tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

Nonresidents Military Partial Residents Residents With Out

I am a resident of Missouri. Are the wages I earn in Missouri for remote work subject to Missouri withholding?

Yes. Any time an employee is performing services in exchange for wages in Missouri, those wages are subject to Missouri withholding. This applies in the case of remote work where an employee is located in Missouri, and performs services for the employer on a remote basis. This rule also applies if the service for which the employee is receiving wages is standing down .

I am a resident of Kansas. I am performing remote work at my residence in Kansas for a Missouri-based employer. Am I obligated to withhold Missouri tax from my wages?

No. If a nonresident employee performs all of his or her services outside of Missouri, the wages paid to that employee are not subject to Missouri withholding.

I am a nonresident with Missouri source income. Why am I required to include my non-Missouri source income on my return?

If you begin with only Missouri source income, your deductions will be too high. You must begin your Missouri return with your total federal adjusted gross income, even if you have income from a state other than Missouri. Your deductions and exemptions apply to your total income, not just your Missouri source income.

For more information, refer to the Resident/Nonresident and Military Status pages.

You May Like: Travis County Tax Office Main

You May Like: H& r Block Tax Refund Calculator

What Happens If You Dont Owe Taxes Or Get A Tax Refund

Most Americans get a tax refund after filing their federal and state taxes. This occurs when you have paid more in taxes over the course of the year than you owe. Most employers withhold money from each paycheck, which go toward your taxes but those withholdings typically dont account for the rebates and credits that you may be eligible for, resulting in the government needing to pay you back in the form of a tax refund.

If you fall into this category, owing no taxes to the government or being owed a tax refund, then there is no penalty that occurs for not filing your taxes. However, you wont receive your tax refund until you do file your taxes. There will be no penalty for filing late, just get the paperwork in to the IRS so they can process your taxes and issue the refund. Technically, you have three years to file taxes and receive a refund.

You May Like: Wheres My Tax Refund Ga

How Do Businesses Not Covered By The Winter Storms Or Winter Wildfire Tax Extension File For Regular Tax Extensions

If your business is not covered by the IRS tax filing extension related to the winter storms in Tennessee, Illinois and Kentucky or the winter wildfire in Colorado, you can still get a six-month extension of time to file your return. If your tax return due date was March 15, 2022, an extension will give you until September 15, 2022. Those with April 18, 2022 due dates can have until October 17, 2022 to file their 2021 year-end income tax returns. If you are a sole proprietor, and you file an extension timely, you will have until October 17, 2022 to file your return.

To obtain an extension of time to file, visit the IRS website to locate and download the appropriate form for your business and filing type. You can also file an extension request electronically when paying part or all of your estimated taxes using the IRS Direct Pay, Electronic Federal Tax Payment System , or when making payments to the IRS using a .

Understand that an extension of time to file is limited to the return filing obligation. The IRS still expects you to pay any taxes owed by the original filing due date . Failing to pay your expected tax obligation by these dates can result in penalties and accrued interest on any unpaid amounts.

Dont Miss: Tax Deduction For Charitable Donations

Recommended Reading: Can You File Taxes On Ssi Disability