Is The New Jersey Sales Tax Destination

New Jersey is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within New Jersey from a New Jersey vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

New Jersey Inheritance And Estate Tax

New Jersey has an inheritance tax. The inheritance tax rate ranges from 11% to 16% and applies only to beneficiaries who are not one of the following in relation to the decedent: mother, father, grandparent, spouse, civil union partner, child, grandchild, great-grandchild, stepchild or domestic partner. Meanwhile, siblings, close friends or step-parents would all be required to pay the inheritance tax, although the first $25,000 of the inheritance is exempt. Anyone outside of these categories will not receive an exemption.

New Jersey has recently phased out its estate tax. As of Jan. 1, 2018, the New Jersey Estate Tax will no longer be imposed on anyone dying on or after that date.

New Jersey Sales Tax Filing Frequency

New Jersey has taxpayers file on a monthly or quarterly basis depending on their annual tax liabilities:

Monthly: For annual tax collections above $30,000 AND collected more than $500 in the first and/or second month of the current calendar quarter

Quarterly: File quarterly if you do not meet the monthly filing conditions

Discounts: As of this posting, New Jersey does not offer any early filing discounts for sales tax

Late Fees: If you file your sales tax return late in New Jersey, the penalty is 5% of the tax due for each month or part of a month the return is late. The maximum penalty for late filing is 25% of the late taxes .

Also Check: What Happens If You File Taxes Twice

New Jersey’s Sales Tax By The Numbers:

New Jersey has ahigher-than-average state sales tax rate, but the actual sales tax rates in most New Jersey cities are lower than averagewhen local sales taxes from New Jersey’s 309 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 28th highest by combined state + local sales tax

Ranked 26th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 4th highest by state sales tax rate

Ranked 16th highest by per capita revenue from the statewide sales tax

New Jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966.

Municipal governments in New Jersey are also allowed to collect a local-option sales tax that ranges from 0% to 2% across the state, with an average local tax of 0.003% .The maximum local tax rate allowed by New Jersey law is < span class=’text-muted’> N/A< /span> .You can lookup New Jersey city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in New Jersey. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the New Jersey Sales Tax Handbook’s Table of Contents above.

Is There Tax On Shoes In New Jersey

As a New Jersey resident, you may be wondering if you have to pay taxes on clothes. The good news is that clothing is not taxable in New Jersey! This means you can shop for clothes without having to pay any extra taxes.

So, is there tax on shoes in new jersey?

Yes, clothing is taxable in New Jersey.

Lets dig into it and see if we can solve the mystery.

Also Check: Filing For An Extension On Taxes 2021

How To Get A Sellers Permit In New Jersey

You can either fill out a paper application and file it in person or you can simply submit an online application. It is strongly recommended that all new businesses file for their sales tax permits through an online tax registration application as it is the easiest and fastest way to apply. For the fastest processing time, please have the following information ready to complete the online application for a New Jersey Sales Tax Number:

Business name, physical/ mailing address & phone numberA short description of the businessThe owner or officers InformationPayment information

Settling A New Jersey Sales Tax Liability

Along the way, or even after one of the critical notices are issued, there is the possibility to settle your New Jersey sales tax case by negotiating with the New Jersey Division of Taxation. Often, you can get better results here than with the auditor.

Without solid experience with state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements.

DO NOT try to negotiate a settlement without an experienced New Jersey state and local tax lawyer or other professional.

Read Also: What Taxes Do You Pay In Texas

Option : Voluntary Disclosure Agreement

New Jerseys lookback period: The standard lookback period isfour years or 16 quarters for returns filed quarterly.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period tofour years. Suppose you should have collected sales tax over the past ten years but didn’t. If that is the case, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

New Jersey Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be very difficult to get the case reopened.

After an audit, the auditor will issue a proposed assessment or audit report. This document details the auditors findings so its important to carefully review and understand its implications.

If, after discussing the areas of contention, the taxpayer still disagrees with the audit findings or any issue of fact or law, the auditor will advise the taxpayer of their right to discuss the matter or meet with the auditors supervisor.

The auditor will then list:

Specific issues of fact or law discussed with the taxpayer.

Laws, rules, or regulations supporting the auditors determinations and whether the taxpayer agrees or disagrees and

The methods the auditor used to make the determinations and whether the taxpayer agrees or disagrees.

Recommended Reading: Donor Advised Funds Tax Deduction

Return The Sales Tax Rate To 7 Percent

Last but not least, lawmakers need to reverse the gimmicky 2016 reduction in the sales tax rate, which has put very little extra cash in the pockets of most New Jersey working families but has blown a large hole in the states budget.

Under the tax cut, which was part of a larger deal to secure long-overdue transportation infrastructure funding, New Jerseys sales tax dropped from 7 percent to 6.625 percent, where it stands today. The cost of this cut is about $600 million a year and growing .

That kind of revenue loss is a huge blow to the state, but because the cost is spread across so many purchases and so many families, it barely registers in the pocketbooks of everyday New Jerseyans. Even the wealthiest 1 percent of families only save an average of $14 a week, while those in the bottom 20 percent earning less than $25,000 will see savings of less than a buck a week. New Jerseyans in the middle 20 percent get an average tax cut of $1.65 a week.

I Should Have Collected New Jersey Sales Tax But I Didn’t

Many of our competitors will suggest Filing aVoluntary Disclosure Agreement in each state. This is a one-size-fits-all solution that isn’t always the best.Our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus, but you have not collected New Jersey sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties .

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best solution for a business is to register with New Jersey and pay back taxes, penalties, and interest.

Be wary of the tax professionals that recommend doing a VDA in these cases. They are looking to make a buck rather than looking out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you’re unsure what your past liabilities are, contact us. Our New Jersey tax professionals work with you so you can make the right choice for your business.

Read Also: How Much Is Bonus Tax

Meadowlands Regional Hotel Use Assessment

Lodging in the Hackensack Meadowlands District is subject to a 3 percent tax. The district is a 30.4 square-mile area along the Hackensack River that covers 14 municipalities in Hudson and Bergen Counties.

This assessment is in addition to the New Jersey sales tax rate and other fees and taxes imposed on lodging.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Recommended Reading: Do I Need To Report Cryptocurrency On My Taxes

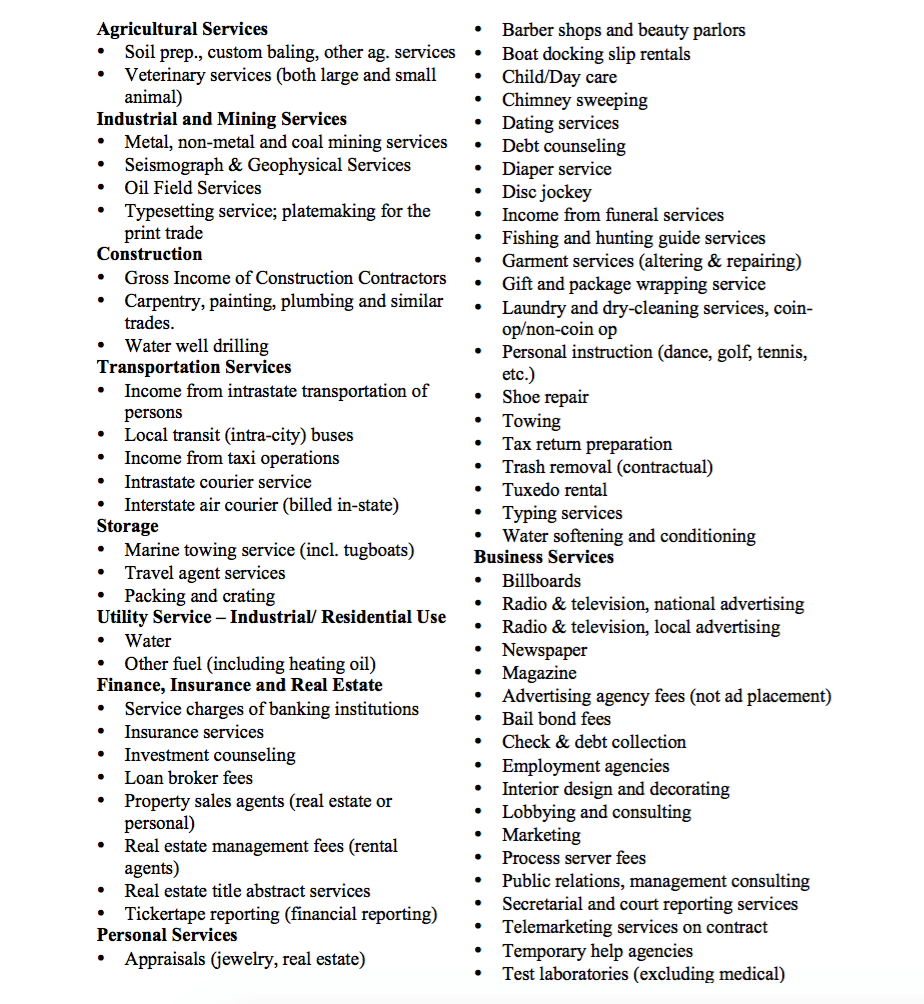

What Items Are Taxable In New Jersey

Most things that we purchase have a sales tax. In New Jersey, the sales tax rate is 6.625%. You may notice that sales tax is being charged at the bottom of your receipt the next time you go shopping. Items that are subject to sales tax in New Jersey are physical items such as automobiles, furniture, fixtures, and meals bought at restaurants.

New Jersey Sales Tax Rates

The State of New Jersey has a flat sales tax rate of 6.625% with no local or municipal taxes. The state does not allow local municipalities to charge these taxes.

In New Jersey, there are 32 Urban Enterprise Zones designated by the state for sales tax relief. These economically depressed areas allow some physical goods to be exempted from sales tax. There are also options for some retailers who qualify to apply for a 50% sales tax reduction, allowing them to charge just 3.3125% instead of 6.625%.

You May Like: Free Amended Tax Return 2020

In New Jersey When Do You Have To Charge Sales Tax

If your business has a sales tax nexus in New Jersey, you must charge sales tax. In different states, the term sales tax nexus signifies different things. It could be having a physical site or having someone working for you in the state. It can also refer to having a affiliate or click through sales tax nexus in the case of ecommerce.

Check the New Jersey governments sales tax website to see if you should be charging sales tax in your state.

Close The Online Travel Loophole And Tax Airbnb Bookings

Right now online travel companies like Expedia, Orbitz and Priceline can avoid collecting all the applicable sales tax on hotel room bookings even though New Jersey collects the tax when travel agents or travelers themselves book the same room. This loophole is not uncommon and costs states between $275 million and $400 million in combined annual revenue.

Here is how the loophole works: online travel companies do collect taxes on applicable sales and lodging taxes but only on the wholesale room rate they pay hotels for the right to rent the rooms, not the higher retail room rate they actually charge renters. They argue that this practice fulfills their tax collecting obligation. However, state routinely tax the full retail price charged to customers for other types of sales found on online travel websites.

To ensure that the full retail room charge is taxed when the room is booked online, New Jersey needs to modernize its law which was written before the advent of the online booking industry. Closing this loophole could generate between $8 million and $12 million more in annual sales tax revenue based on 2010 data.

Also Check: Payroll Tax Vs Income Tax

How Can I Avoid Paying The Tax On Shoes In New Jersey

There is no easy way to avoid paying the tax on shoes in New Jersey, but there are a few strategies that you can use to try to minimize the amount of tax that you have to pay. One strategy is to only buy shoes that are on sale. Another strategy is to buy shoes that are tax-free. Finally, you can try to purchase shoes from a store that is located in a state that does not have a sales tax.

Registering For Tax Purposes/business Registration Certificate

If you are doing business in New Jersey, you must register for tax purposes by completing the NJ-REG form with the New Jersey Division of Revenue and Enterprise Services . Failure to register for taxes will delay your ability to pay taxes owed to the state and can result in penalties and fees in addition to the amount of taxes owed.

When you complete the NJ-REG form, you will be prompted to identify the taxes your business will be required to collect and/or pay.

Although there are several types of taxes, the most common types are based on:

- Income tax: These are taxes collected on your businessâs net income and profits

- Sales and Use Tax: These are taxes paid for the sale of taxable goods and services

- Payroll Taxes and Wage Withholding: These are taxes held on your payroll

To complete the NJ-REG form, you will need:

- Your business Entity ID

- Your business EIN

- Your NAICS code

- Your NJ business code

Once you complete your registration, you will receive a registration confirmation with your New Jersey Tax ID number and a Business Registration Certificate . Your New Jersey Tax ID number will be the same as your EIN plus a 3-digit suffix and is used for state tax purposes. Your BRC will include a control number used only to verify that your certificate is current. You must display this document in your place of business. If you completed your application online, you will be issued a printable BRC immediately with a paper form being mailed to you in a few weeks.

Recommended Reading: Boat Loan Calculator With Tax

Reverse The Tax Break For Yacht And Boat Buyers

In 2016, New Jersey cut the sales tax on boats and other vessels sold in the state in half and capped the sales tax on boats at $20,000 meaning that buyers of the most expensive boats are receiving even larger tax breaks. For example, an 80-foot yacht in the $5 million range used to be subject to a $350,000 sales tax. That same luxury boat is now subject to just $20,000 in sales tax a 94 percent tax cut. The special and unnecessary exemption for boaters is estimated to cost the state between $8 million and $15 million in annual revenue.

At a time when the state has not increased funding for TANF for over 30 years, it certainly sends the wrong message to provide such tax breaks for those who need it the least. This 2015 sales tax cut should be reversed.

New Jersey Sales Tax And You: An Overview

When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller collects tax at the time of the sale and sends it to the State. The law exempts some sales and services from Sales Tax.

Some examples of taxable items are:

- Automobiles, furniture, carpeting, and meals bought in restaurants.

Some examples of taxable services are:

- Lawn maintenance, auto repair, snow removal, and telecommunications.

Some examples of nontaxable goods and services are:

- Unprepared food for human consumption, clothing, certain professional and personal services, and real estate sales.

Publication S& U-4, New Jersey Sales Tax Guide, provides further information on Sales Tax. It includes extensive listings of taxable and exempt items and services.

Are There Any Exemptions to Paying Sales Tax?

Some sales are exempt from Sales Tax. When a purchaser claims a tax exemption on a sale, she or he must provide each seller with a tax exemption certificate. Different certificates are required for different types of sales.

These forms are available at exemption certificates.

For more information on Sales Tax exemptions, please see our publication S& U-6 .

What if I Purchased a Taxable Item or Service and Was Not Charged New Jersey Sales Tax?

If you buy a taxable item or service from a company and are not charged Sales Tax, you may have to pay Use Tax to New Jersey. For more information please visit our page: “Do You or Your Business Owe New Jersey Use Tax?”

Recommended Reading: Irs Status On Tax Return