Irs Phone Numbers For Specific Tax Issues

In many cases, you shouldn’t call the main number. You’ll get faster and better service if you call one of the IRS’s specific phone numbers. Here is a list of the IRS’s phone numbers and links to resources with more information about each of these topics.

| Tax Assistance for deaf or hard of hearing | 800-829-4059 |

|---|

What Should I Do

When can I check on my refund?

- Did you file your tax return electronically? Within 24 hours after the IRS receives your tax return.

- Did you file a paper return? Four weeks after mailing your tax return.

- Did you file an amended return? Refund information wont be available online, whether you filed your tax return electronically or on paper. Call the IRS at 800-829-1040 You can, however, check the status of your amended tax return with Wheres My Amended Return? on IRS.gov. It should generally be available three weeks after you mail the amended tax return to the IRS.

When checking on your refund, have this information available:

- Your Social Security number or Individual Taxpayer Identification Number or your spouses SSN or ITIN, if you filed a joint tax return.

- Your filing status .

- The exact refund amount shown on the tax return.

- If you chose to get your refund by direct deposit or paper check.

- If you selected direct deposit, did you ask the IRS to divide it among multiple accounts?

Was the refund a Refund Anticipation Check or Refund Anticipation Loan? Contact your tax return preparer.

If you didnt receive your refund or didnt get the amount you expected, there are several possible reasons why

- The refund was lost or stolen.

There are steps you can take to determine which of the above reasons is most likely the I dont have my refund common situation will take you through the possibilities.

What Not To Do To Try To Get Answers From The Irs

Being persistent when you call the IRS and even trying some of the tips for navigating the automated system may help you get what you need in due time. Just remember that youâre not the only taxpayer in this frustrating situationâyouâre one of millions trying to get answers.

With three stimulus rounds and the enhanced child tax credit on top of routine taxes, âthatâs a lot to put on any system, from an infrastructure and manpower standpoint,â Bell says.

What not to do? Donât put the IRS on blast on social media , and donât ask your friendsâ friend who works for the IRS to look into your case for you.

âThey canât help you. You donât want to get them in trouble,â Bell says.

Read Also: Free H& r Block Tax

How To Speak To A Live Person At The Irs

To reach the IRS, just pick up the phone and call 1-800-829-1040. Then, prepare to wait on hold for a long time. Make sure you’re ready when the agent answers if you’re not, you will have to hang up and start the process over again.

The IRS’s phone trees are impossibly long, and although most menus let you push “9” to hear your options again, it typically only repeats once before disconnecting you.

To reach a live person at the IRS about your individual taxes, select these options: 1, 2, 1, 3, 2, ignore two requests for your Social Security Number, 2, 4.

If you want to talk with a live person about your business taxes, select these options: 1, 2, 1, 3, 2, ignore two requests for your Social Security Number, 1, 4.

Here’s exactly what happens when you call. These instructions are correct as of September 2022, but the IRS phone tree is subject to change.

- Select 1 for English

- Select 2 for personal income tax returns

- Select 1 for tax forms, tax history, or payments

- Select 3 for all other questions

- Select 2 for all other questions.

- Then, the system will ask for your Social Security Number or Employer Identification Number. It will ask twice. Just wait don’t enter anything.

- Then, press 2 for individual taxes or 1 for business taxes.

- Finally, press 4 for all other inquiries.

At this point, you will be put on hold until a live agent answers the phone. This is the fastest way to reach a real person at the IRS.

Irs Phone Numbers And Website

At www.irs.gov you can find:

- Forms, worksheets, and publications needed to complete your return

- Advice and FAQs

- Information on new and changing tax laws

- Links and information for your state taxes

- Online tools and calculators

To contact the IRS, call:

- Customer service 800-829-1040

- Questions about refunds and offsets to IRS liabilities 800-829-1954

- Taxpayer advocate service 877-777-4778

To pay tax by credit card Call any of these numbers:

To learn more, see these tax tips:

- Amended Return Form 1040X

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

Don’t Miss: Do I Need To Report Cryptocurrency On My Taxes

Forgetting To Sign Your Return

Sending in an unsigned paper return is like sending in no return at all. At that point, its not valid, says Smith. We have to send it back to you for your signature. Then you have to send it back to us. So, unfortunately, it then becomes part of our paper backlog.

Tax software, however, has built-in prompts that wont let you e-file without an electronic signature, which is another reason to file electronically. Its pretty much foolproof, says Raven Deerwater, an enrolled agent in Mendocino, Calif. Enrolled agents prepare tax returns and also represent taxpayers before the IRS.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Visit Your Local Irs Office

The IRS operates local Taxpayer Assistance Center offices, or TACs, in every state. To see their local addresses and phone numbers, click on your state on the list of Taxpayer Assistance locations. Generally, you cant just show up at a local IRS office any time. You have to make an appointment. That IRS number is 844-545-5640.

Recommended Reading: How To Check If Your Taxes Were Filed

What Do I Need To Know

The Protecting Americans From Tax Hikes Act made the following changes, which became effective for the 2017 filing season, to help prevent revenue loss due to identity theft and refund fraud related to fabricated wages and withholdings:

- The IRS may not issue a credit or refund to you before February 15, if you claim the Earned Income Tax Credit or Additional Child Tax Credit on your tax return.

- This change only affects returns claiming EITC or ACTC filed before February 15.

- The IRS will hold your entire refund, including any part of your refund not associated with the EITC or ACTC.

- Neither TAS, nor the IRS, can release any part of your refund before that date, even if youre experiencing a financial hardship.

Do you need to check the status of your refund?

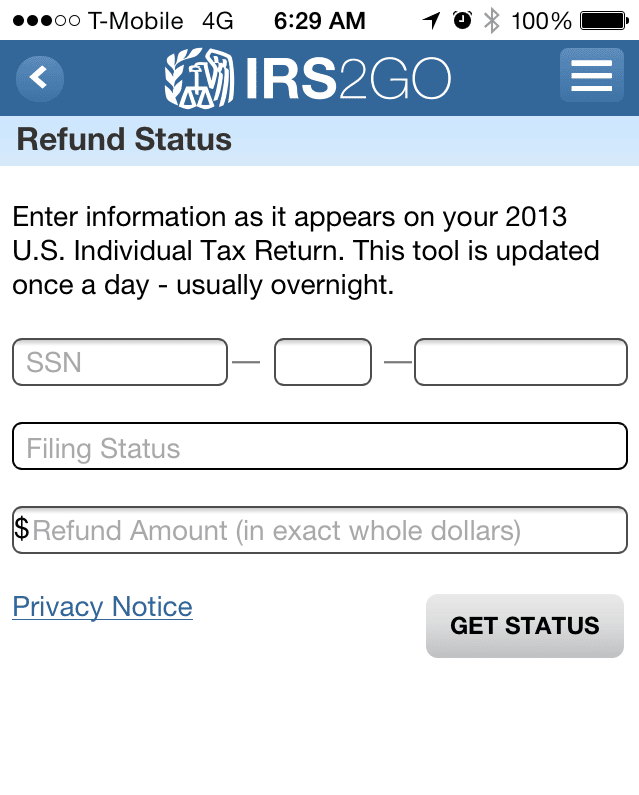

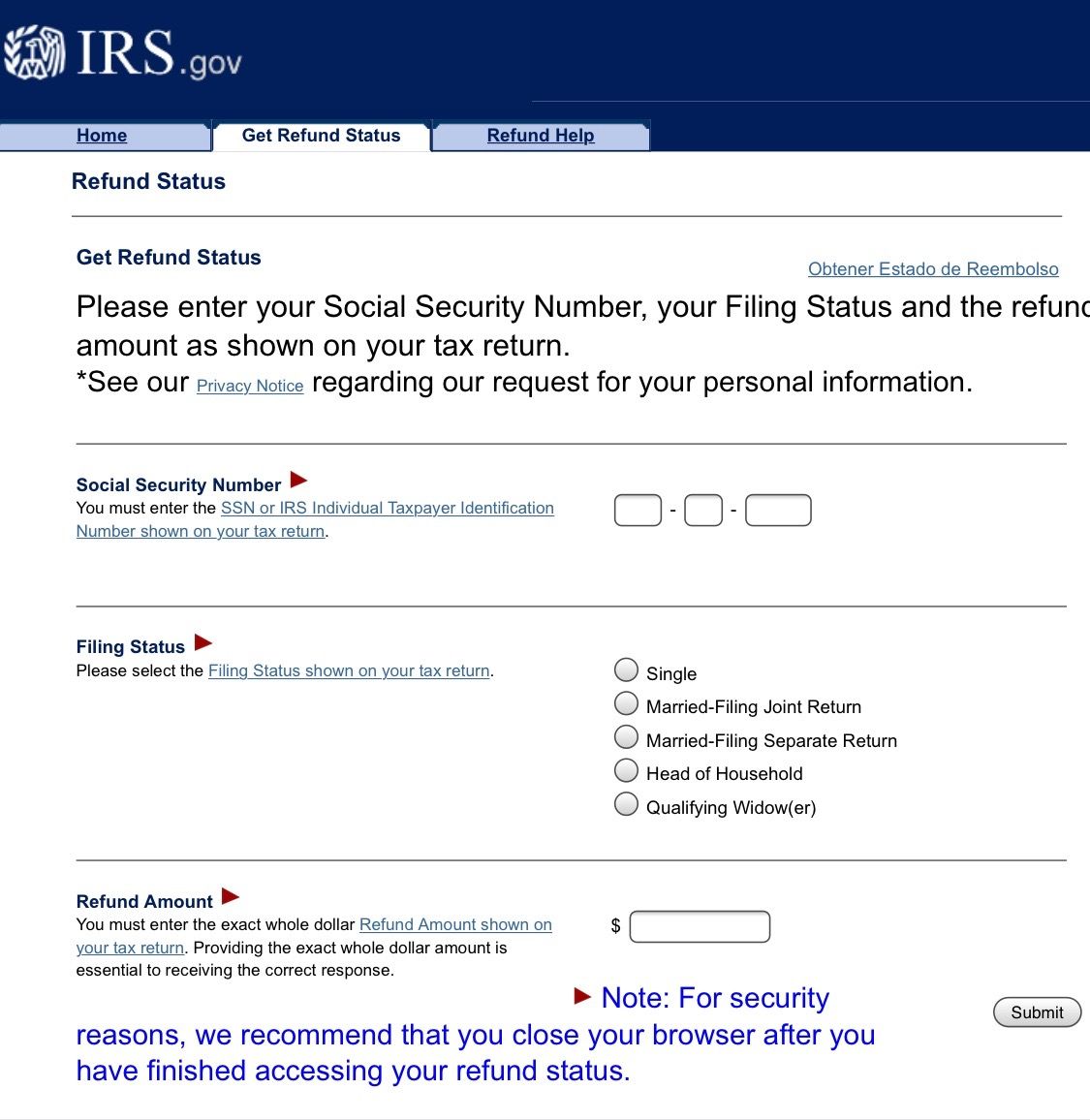

You can check the status of your refund with the Wheres My Refund? tool or the IRS2Go mobile app.

How Do You Speak To A Live Person At The Irs

Did this post save you a ton of time and heartache? Consider buying me a cup of coffee. Thanks so much!

Also Check: H& r Block 2022 Tax Software

Find A Local Irs Office

If you can’t reach a live person at the IRS, you may want to make an appointment at a local Taxpayer Assistance Center Office. Use the IRS local office locator to find a location in your area.

Put your zip code in the search box and the radius you’re willing to travel. Then, a list of local Taxpayer Assistance Centers will appear. Each listing will show the address of the IRS office, its hours, and a list of local services. You can’t just show up. You need to schedule an appointment. Regardless of where you live, you can call 844-545-5640 to make an in-person appointment with IRS taxpayer assistance.

Reach The Irs By Mail

While the IRS itself discourages doing so, its still possible to send in your tax forms by mail, including tax payments. This is usually the slowest method of interacting with the IRS by a long shot. Minimum wait times for a reply by mail from the IRS is around 30 days, and youll often have to wait considerably longer than that. As of publishing time, the IRS even warns of additional delays due to staffing shortages.

We wont provide the address here because the IRS could change them at any time, and they vary from state to state and whether youre including a payment or not. To find the right mailing address for your correspondence, visit this resource from the IRS.

Recommended Reading: Can I Still File My 2017 Taxes Electronically In 2021

Why Have The Irs Not Processed 2022 Returns

These are unprecedented delays when it is considered that before the pandemic, the IRS tended to deliver refunds to paper filers within four and six weeks. Over the past year, that has risen to over six months which means many Americans are left wondering what is going on.

There is a fair amount of money on its way to many filers as well as the average refund this year is 3,039 dollars according to some estimates.

How To Get Through To The Irs

Whatâs a taxpayer to do if you have questions and the information in your online account doesnât solve the mystery? What if the IRS sends you a billing notice for something you already paid?

Your first step should be to check your online account at IRS.gov. This free account is free to set up, and allows you to view information about your balances, prior tax records, payments and economic impact payments .

If your online account doesnât have the information you need, Bell offers a few tips for maintaining your cool as you navigate IRS systems during this incredibly trying time.

Also Check: How Long Do Taxes Take To Come

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Try Calling The Taxpayer Advocate Service

The Taxpayer Advocate Service is an independent organization within the IRS that can help people with tax problems they can’t resolve on their own. Every state has at least one local Taxpayer Advocate Service center that is independent of the local IRS office, and it reports to the national Taxpayer Advocate Service. You can see the local addresses and phone numbers for every local Taxpayer Advocate Service office here.

Recommended Reading: How Does Income Tax Work

Use The Wheres My Refund Toolbut Understand Its Limitations

The IRS encourages taxpayers to use the Whereâs My Refund tool to check the status of their tax return instead of calling the agency. The tool displays your refund status for the most recent tax year the IRS has on file with one of three status notes: refund received, refund approved, or refund sent. Youâll need to enter your Social Security number, filing status and the expected refund amount to access this information.

But the Taxpayer Advocate Service notes limitations to the tool: It doesnât explain why your refund is delayed, where the return is in the filing process, or steps you need to take to address the delay.

âIt just reflects that the return has been received, that the refund was approved, or that the refund was sent,â the officeâs 2021 report to Congress, written by Collins, explained. âFor millions of taxpayers, that meant many months without any status updates, and some are still waiting for their refunds.â

Customer service representatives often lack additional information that can put a taxpayer at ease, the report said. âParticularly for taxpayers who need their refunds to pay for current living expenses, the absence of information can cause deep concern and sometimes panic, leading to more telephone calls that are just as unproductive.â

Get Ready For Whats New For Tax Year 2022

November 26, 2022 – With the end of the year approaching, time is running out to take advantage of the Tax Withholding Estimator. This online tool is designed to help taxpayers determine the right amount of tax to have withheld from their paycheck. Some people may have life changes like getting married or divorced, welcoming a child or taking on a second job. Other taxpayers may need to consider estimated tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The last quarterly payment for 2022 is due on January 17, 2023. The Tax Withholding Estimator can help wage earners determine if there is a need to adjust their withholding, consider additional tax payments, or submit a new W-4 form to their employer to avoid an unexpected tax bill when they file.

As taxpayers gather tax records, they should remember that most income is taxable. This includes unemployment income, refund interest and income from the gig economy and digital assets.

Credit amounts also change each year like the Child Tax Credit , Earned Income Tax Credit and Dependent Care Credit. Taxpayers can use the Interactive Tax Assistant on IRS.gov to determine their eligibility for tax credits. Some taxpayers may qualify this year for the expanded eligibility for the Premium Tax Credit, while others may qualify for a Clean Vehicle Credit through the Inflation Reduction Act of 2022.

Recommended Reading: Us Individual Income Tax Return

Where Is My Refund

If youve already filed your tax return in the last month or so, but havent gotten your refund yet, you may be wondering: Where is my refund?

The IRS, in general, processes refunds in approximately 21 days, if you filed electronically, and six weeks if you filed a paper tax return. However, there are several things that could delay or stop you from receiving the refund, in full or in part. Below are some of the main reasons you may not have received your refund yet, and tools to help you find out the status of it, along with self-help information to assist you should you need it.

Get Ready By Gathering Tax Records

When filers have all their tax documentation gathered and organized, theyre in the best position to file an accurate return and avoid processing or refund delays or receiving IRS letters. Nows a good time for taxpayers to consider financial transactions that occurred in 2022, if theyre taxable and how they should be reported.

The IRS encourages taxpayers to develop an electronic or paper recordkeeping system to store tax-related information in one place for easy access. Taxpayers should keep copies of filed tax returns and their supporting documents for at least three years.

Before January, taxpayers should confirm that their employer, bank and other payers have their current mailing address and email address to ensure they receive their year-end financial statements. Typically, year-end forms start arriving by mail or are available online in mid-to-late January. Taxpayers should carefully review each income statement for accuracy and contact the issuer to correct information that needs to be updated.

Recommended Reading: Montgomery County Texas Property Tax

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

As a result, delays in completing paper returns have been running from six months up to one year.