Tax Extension: What To Do Before The Tax Extension Filing Deadline

3 importants steps to take as soon as possible

- Mortgage Rates.When should you refinance your mortgage?

Its almost time for the roughly 19 million Americans who asked for an extension to submit their 2021 tax returns. The IRS states that taxpayers who asked for more time had until to file an appropriate return.

To avoid processing delays, those who asked for an extension but already have all they need to apply are urged to submit electronically before the deadline.

There are crucial actions taxpayers who asked for an extension can do as the deadline approaches to enhance their situation.

Consult a tax debt relief specialist if youre concerned about the amount of taxes you owe and arent sure what to do next. There are numerous approaches to dealing with unpaid tax liability.

Read Also: How Does Inheritance Tax Work

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Can You File A Tax Extension Online

The vast majority of tax returns are filed electronically these days. The good news is if you need to file an extension, you can do so online as well. Here are the steps:

Using your online tax software, or theFree File program offered by the IRS, obtain and fill out IRS extension Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Submit your completed tax extension form electronically to the IRS.

Providing you meet the qualifying criteria, youll be automatically granted a six-month extension to file your 2020 tax return.

Related: How To Pay Off Back Taxes

You May Like: Property Taxes In New Hampshire

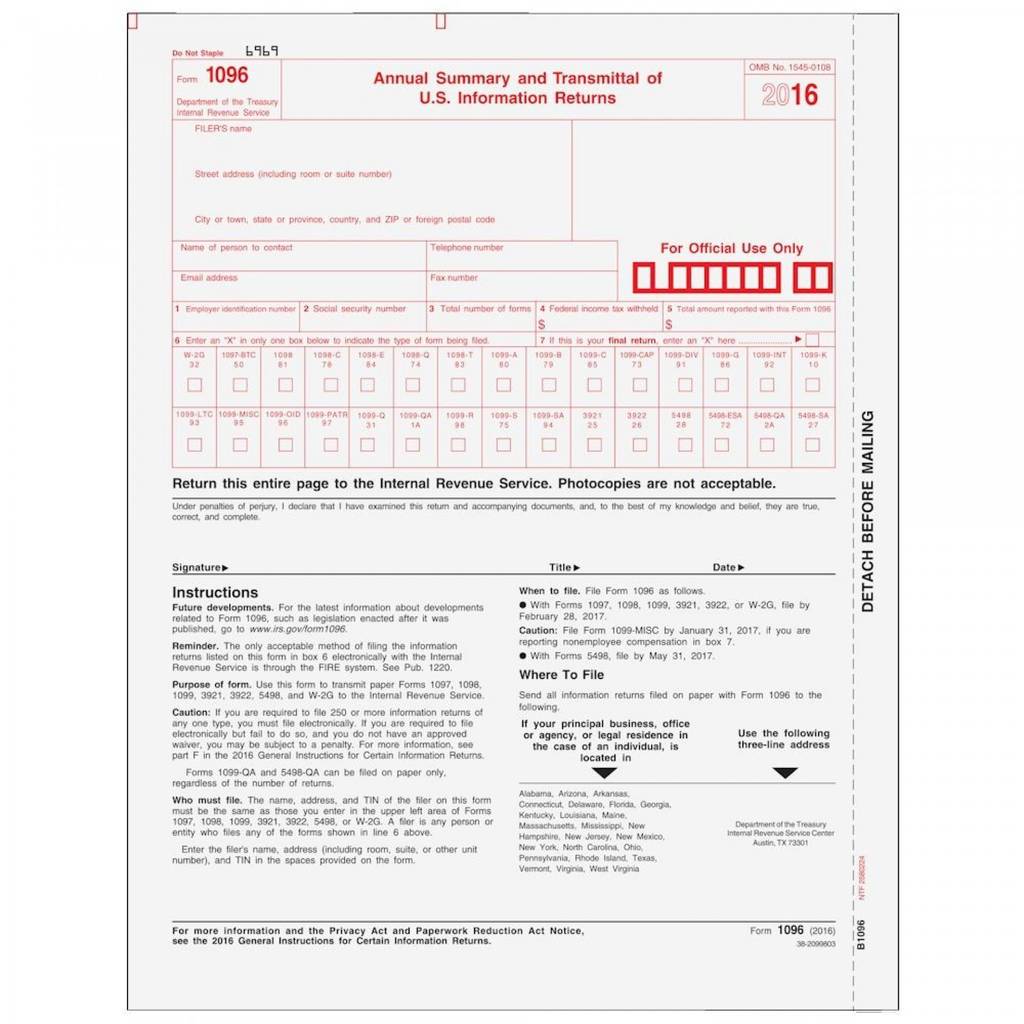

How To File A Tax Extension By Mail

The process for filing a tax extension by mail is the same as filing online, except youll need to submit a hard copy of the required form. Heres how:

Obtain and fill out IRS extension Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Mail your completed tax extension form for 2020 to the IRS using the correct address for your location you can find it on page 4 of Form 4868.

Once youve filed your completed tax extension form, youll automatically get the six-month extension to file your 2020 tax return, provided you meet the qualifying criteria.

Its possible to get the automatic extension for an individual tax return without filing the IRS 4868 tax form. To do this, pay all or part of your estimated income taxes that are due. You must provide relevant tax information and indicate that the payment is for a tax-filing extension using one of the IRS-approved methods of payment. Youll then receive a confirmation number for your records.

Find Out: What To Do When You Cant Pay Your Tax Bill

What If I Don’t File By October 17

People who fail to file their return by the extended tax deadline will face harsher penalties. The IRS charges 5% of the unpaid taxes for each month that a tax return is late or 10 times more than the underpayment penalty. It caps the penalty at 25% of your unpaid taxes. The tax agency also charges interest on the penalty.

You May Like: How To Amend Tax Return Turbotax

I Just Efiled My Federal Taxes How Do I Get An Extension On State Taxes For Ny

If you cannot file on time, you can request an automatic extension of time to file.

How to request your extension

- You can complete your request for free using New Yorks online service.

- You must e-file your extension if you prepare your extension using software that supports e-file.

- If your paid preparer is required to e-file your tax return, and is also preparing your extension request, the preparer must e-file your extension request.

Through TurboTax:

If youve already completed the New York return, follow steps 1 & 2, then scroll toOther Forms and Voluntary Contributions, update Other Forms 0

Tax Extension Filing Faqs

If you need more time to file your individual federal income tax return, you can request an automatic extension from the IRS using Form 4868. The filing deadline to request a tax extension is the same as filing your return, April 18, 2022.

A tax extension will give you an additional six months to file your taxes this years tax extension due date is Oct. 17, 2022.

No, a tax extension only gives you more time to file your return it doesnt give you extra time to pay any taxes you owe. You must pay your tax bill by the Tax Day deadline to avoid late payment penalties.

When you request a tax extension with Form 4868, you can estimate and pay your total tax liability for the tax year. To help estimate your potential tax liability, try to complete your return as much as possible, estimating wherever necessary.

Filing for an extension is an excellent option for many taxpayers who feel stressed about tax season or have other commitments on their plate and just need more time.

Requesting an extension from the IRS is also an easy process, and you dont need to give a compelling reason why you need more time to file. So long as you submit your extension request form on time and correctly, approval is typically automatic, and youre granted an extension.

The downside of filing a tax extension is that it only gives you more time to file, not more time to pay. As discussed in the last section, youll still need to estimate and pay any taxes you might owe by the tax filing deadline .

Recommended Reading: How To File Self Employed Taxes

Administrative Procedure Ap : Extensions Of Time To File Tax Returns

| Date: |

|---|

| Massachusetts General Laws |

Although every tax return is required to be filed by a certain due date, sometimes those dates can be extended to allow taxpayers more time to file their returns without incurring any penalties. In many instances, taxpayers automatically receive at least six extra months to file their tax returns, as long as they satisfy certain tax payment requirements. A taxpayer may file the return at any time within the extension period.

Taxpayers needing more time than the amount provided automatically should contact the Department for assistance at 887-MDOR or tollfree within Massachusetts at 1 392-6089.

Please note that an extension of time to file does not extend the time to pay the tax due. Any tax due is still required to be paid by the original due date of the return.

Writing And Sending A Letter To The Irs

There is no way to send an online email or message to the IRS requesting an extension to file US taxes until the December 15 deadline. Instead, youll have to use the traditional route of writing and mailing a physical letter to the IRS. This process is according to the current regulations by the US Treasury.

Points to write in the letter:

- Your full name and Social Security Number

- Which tax return or documents and the year or tax period you need to get an extension for.

- A reason why the IRS should grant you the time to extend your tax filing obligation to December 15 . This could be because it takes extra time to collect expense and income documents to prepare your 2021 tax return. Especially since you live abroad as a US citizen, and communication and mailing delays could happen. Whatever is truthful and applies to your situation should work. Its crucial you come off confident and as a conscientious taxpayer.

Example Letterfor the IRS

Date

I, , with Social Security Number request an extension to file Form 1040 for the 2021 tax year until December 15, 2022. The reason is ______ . I sincerely hope I can have this extension.

Best regards,

Also Check: Montgomery County Texas Property Tax

Asking For A Small Extension

An employer may need to hire someone as soon as possible, so asking for a small extension may be all right, but asking for several weeks may not be acceptable.

A teacher or professor may be willing to grant an extension that is within the timing of the current semester, but not an extension that goes into the summer vacation or next semester.

Here are sample of an extension request letters. It should be sent by certified mail, so the sender has proof of the date it was sent and received.

Any enclosures should be copies, and no original documents should be sent. If the extension is granted, a follow up letter of appreciation should be sent immediately.

City, State, Zip Code

Dear Receivers Name,

I am enrolled in your English Literature 101 class and have been absent for the past five weeks because of injuries I sustained in an automobile accident.

You have kindly accommodated my situation by allowing me to turn in my homework late, and this has helped make it possible for me to remain enrolled in the university and not lose a semester, and I am very grateful to you.

I have been released from the hospital, but still need to walk with crutches for the next month. Because of this inconvenience, it will be very difficult to do the required research for the mid-term paper that is due on DATE.

I would like to ask for an extension of 10 days to complete the paper. It is my intention to submit the paper to you on DATE.

Sincerely,

RE: Request for an extension of loan payments

Can I File A Tax Extension Electronically Free Of Charge

Yes, you can. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS Free Fillable forms, assuming they are comfortable handling their taxes. If thats not the case, there are several tax-software companies that offer free filing under certain conditions.

Also Check: How Much Medicare Tax Is Withheld

Free File: Everyone Can File An Extension For Free

The following companies partner with the IRS Free File program, so that you can e-file your tax filing extension for free. Please be aware that filing an extension gives you time to e-file your federal tax return. If you have a balance due, the deadline to pay is still April 18, 2022. However, if you want to file your taxes now with free, easy to use software use IRS Free File.

Tax Extensions For Survivors

If youre a survivor of a service member who died on active duty, you may have the option of taking extra time to file your tax return.

The deadline for filing tax returns, paying taxes, filing claims for refunds and taking other actions with the Internal Revenue Service may be extended for 180 days after:

- The last day the service member was in a combat zone, had qualifying service outside of the combat zone, or served in a contingency operation

- The last day of any continuous qualified hospitalization for injury from service in the combat zone or contingency operation or while performing qualifying service outside of the combat zone, .

Military OneSource MilTax helps service members and their families address tax situations specific to military life, including tax forgiveness, refunds and extensions for surviving family members.

Read Also: Federal Small Business Tax Rate

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

Don’t Miss: What Percentage Is Self Employment Tax

Sole Proprietor Income Tax Returns Deadline

Sole proprietors report business income with form 1040 and Schedule C profit or loss form. The process is an annual process for reporting business deductions and income. Apart from all these, they also need to file the schedule SE, self-employment tax. Other schedules and forms are applicable depending on the business activities and their nature. For taxpayers following the calendar year, the due date falls on April 15th extends to May 17, 2020. Form 4868 filing helps in an automatic extension of six months.

What If I Can’t Afford To Pay My Taxes

The only way to avoid penalties for sure is by paying your taxes on time. If you can’t afford to pay all of your taxes, pay as much as you can by the filing deadline and request a payment plan for the rest.

Whether you qualify for a payment plan depends on your tax situation. The IRS offers long-term and short-term payment plans to qualifying taxpayers.

Recommended Reading: How To File 2020 Taxes

Extensions Of Time To File Tax Returns Some Taxpayers Instantly Qualify

IR-2022-88, April 18, 2022

WASHINGTON Taxpayers requesting an extension will have until Monday, Oct. 17, 2022, to file a return. Not everyone has to ask for more time, however. Disaster victims, taxpayers serving in combat zones and those living abroad automatically have longer to file.

An extension of time to file will also automatically process when taxpayers pay all or part of their taxes electronically by this year’s original due date of April 18, 2022. Although taxpayers can file up to six months later when they have an extension, taxes are still owed by the original due date.

Here’s more about those who get automatic extensions:

Submit Georgia Form It

You must mail Form IT-303 before the statutory return due date and attach a copy to the return when filed. We will notify you only if your extension request is denied.

An extension to file cannot exceed 6 months and does not extend the date for paying the tax.

Tax must be mailed, along with Form IT-560, by the statutory due date for filing the return to avoid late payment penalty and interest. The amount paid should be entered on Form 500, Page 2, Line 20.

You May Like: Is Credit Card Interest Tax Deductible

Prepayment Requirements For Filing Extension

You must prepay by the original due date:

- 90 percent of your 2021 tax due

- 100 percent of your 2020 tax liability or

- 90 percent of your 2021 tax due if you did not have a Utah tax liability in 2020 or if this is your first year filing.

You may prepay through withholding , payments applied from previous year refunds, credits and credit carryovers, or payments made by the tax due date using form TC-546, Individual Income Tax Prepayment Coupon, or at tap.utah.gov. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full. Penalties may also apply.

Irs Free File And Other Resources

IRS Free File is available to any person or family with an adjusted gross income of $73,000 or less in 2021. Leading tax software providers make their online products available for free. Taxpayers can use IRS Free File to claim the Child Tax Credit, the Earned Income Tax Credit and other important credits. IRS Free File Fillable Forms is available for taxpayers whose 2021 AGI is greater than $73,000 and are comfortable preparing their own tax returnso there is a free option for everyone.

Online Account provides information to help file an accurate return, including Advance Child Tax Credit and Economic Impact Payment amounts, AGI amounts from last year’s tax return, estimated tax payment amounts and refunds applied as a credit.

Taxpayers can also get answers to many tax law questions by using the IRS’s Interactive Tax Assistant tool.

Additionally, taxpayers can view tax information in several languages by clicking on the “English” tab located on the IRS.gov home page.

Also Check: What Is The Tax Filing Deadline