C In The Above Computation Indexation Means:

Indexation is the process that takes into account inflation from the time taxpayer bought the asset to the time taxpayer sell it. The way it works is that it allows taxpayer to inflate the purchase price of the asset to take into account the impact of inflation. The end result is that you get the benefit of lowering your tax liability.

Formula for calculating the indexation:

How Are Capital Gains Calculated

Capital gains and losses are calculated by subtracting the amount you paid for an asset from the amount you sold it for.

If the selling price was lower than what you had paid for the asset originally, then it is a capital loss.

You can then use this amount to calculate your capital gains tax.

Dont Miss: Short-term Rental Tax Loophole

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed on Form 1040 by your total taxable income .

-

Income thresholds for tax brackets are updated annually. Several provisions in the tax code, including the income thresholds that inform the federal tax brackets, are adjusted annually to reflect the rate of inflation. This indexing aims to prevent taxpayers from experiencing “bracket creep,” or the process of being pushed into a higher tax bracket because of inflation.

-

That’s the deal only for federal income taxes. Your state might have different brackets, a flat income tax or no income tax at all.

» Learn more:See state income tax brackets here

Don’t Miss: Are Funeral Expenses Tax Deductable

What Is Capital Gains Tax

Capital gains taxes are the taxes you pay on any profits you make from selling investments, like stocks, bonds, properties, cars, or businesses. The tax isnt applied for owning these assets it only hits when you profit from selling them.

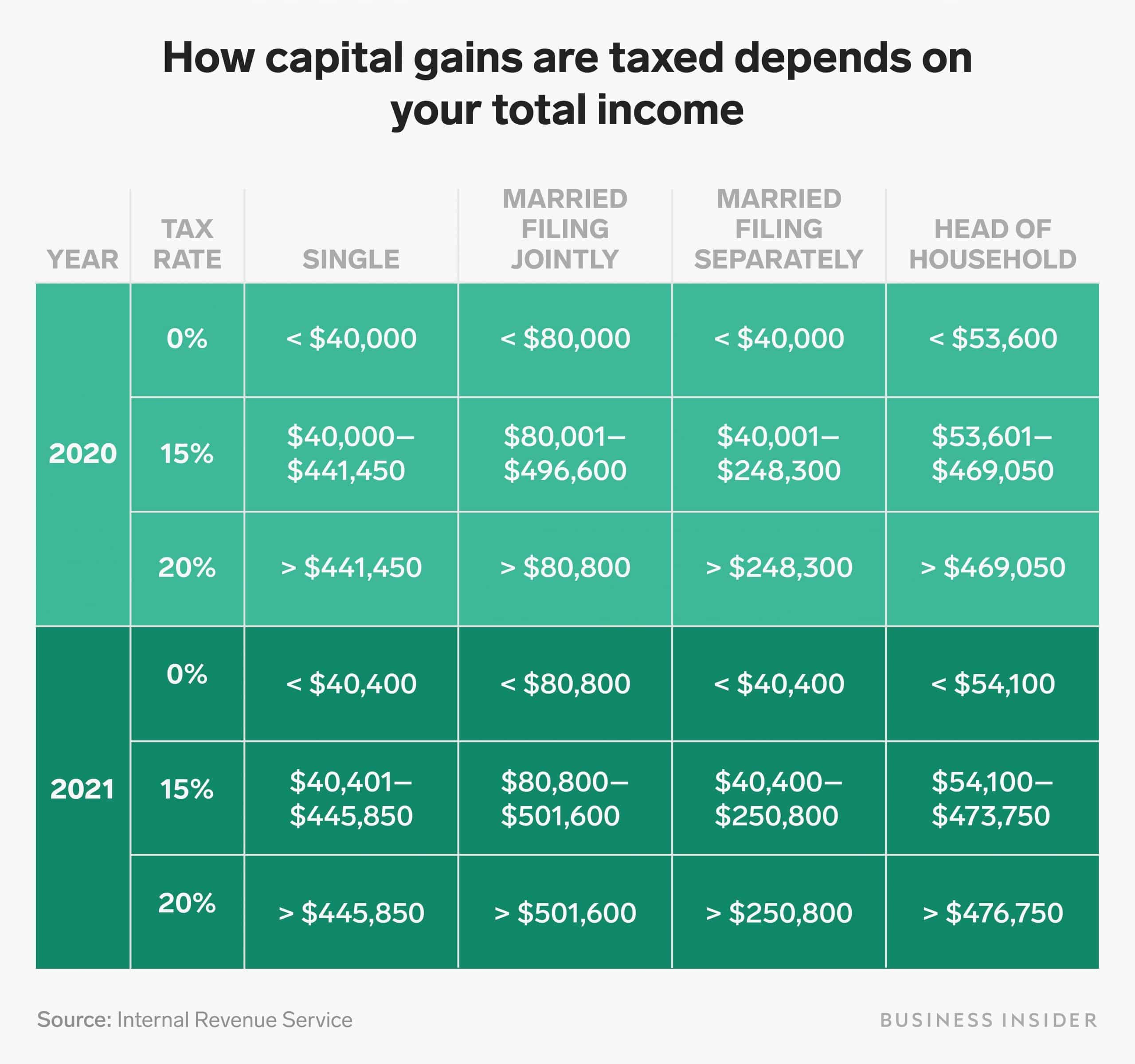

Its important for beginner investors to understand that a number of factors can affect their capital gains tax rate: how long they hold onto an investment, which asset theyre selling, the amount of their annual income, as well as their marital status.

Heres a guide on how to calculate stock profits, and below are some basic facts about capital gains taxes.

Adjust Your Income Accordingly

If you are raising a family in a higher cost of living area, then youll probably want to accumulate at least $5 million in after-tax investments instead. One of the key expenses I overestimated in my original $200,000 budget chart was the 25% total effective tax rate. It turns out their total effective tax rate is closer to 17% instead, which buys the couple $16,000 more.

The beauty of the long-term capital gains tax rate is that even if you end up generating more income, you still get the first $38,600 or $77,200 in gains tax-free depending if you are single or married.

Therefore, to the extent you can generate more, you might as well keep going until you find your optimal level for financial freedom.

With Joe Biden as President, expect to see income tax rates go up for households making over $400,000 a year. As a result, the short-term capital gains tax rate will go up for households in this category as well.

Personally, Im looking to take things down a notch during the Biden Presidency. Weve had a fantastic run in the stock market and real estate market. Im tired from the pandemic and really want to spend more of my gains and catch up on life.

Besides, there could very well be a long-term capital gains tax hike as well. With income taxes and capital gains taxes going up, if you are exhausted, its probably best to take things down a notch and enjoy life more.

Read Also: What If You Don’t Pay Taxes

Limit On The Deduction And Carryover Of Losses

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 or your total net loss shown on line 16 of Schedule D . Claim the loss on line 7 of your Form 1040 or Form 1040-SR. If your net capital loss is more than this limit, you can carry the loss forward to later years. You may use the Capital Loss Carryover Worksheet found in Publication 550, Investment Income and Expenses or in the Instructions for Schedule D PDF to figure the amount you can carry forward.

How To Avoid Capital Gains Tax On A Home Sale

Capital gains taxes can greatly affect your bottom line. Fortunately, there are ways to reduce the tax bill, or avoid capital gains taxes on a home sale altogether. It depends on the property type and your filing status. The IRS offers a few scenarios to avoid capital gains taxes when selling your house.

Also Check: Irs Solar Tax Credit 2021 Form

Don’t Miss: When Does Tax Season Start 2022

Consider Using A Retirement Account

-

Owning dividend-paying investments inside one could shelter dividends from taxes or defer taxes on them. Think ahead, though. Do you need the income now?

-

Also, the type of retirement account matters when it comes to determining the tax bill. When you eventually withdraw money from a traditional IRA, for example, it may be taxed at your ordinary income tax rate rather than at those lower qualified dividend tax rates. If you qualify for a Roth IRA, you wont receive a tax break on the contribution, but your eventual withdrawals after age 59 ½ may be tax-free.

Lowering Taxes With Installment Sales

If you are selling a rental property or a second home, you may want to look into installment sales. This will defer part of the gain that you made from the sale to a later time, thus reducing your taxable income. You will then receive payments that include principle, gain, and interest. The principle will not be taxed, and the interest will be taxed. Finally, instead of getting taxed on the lump sum, the fractional part of the gain will result in a lower total tax. You will also need to look into if you are going to be taxed for long-term or short-term capital gains, which is determined based on how long you owned the property before selling it.

Recommended Reading: How Do I File Back Taxes

A Guide To The Capital Gains Tax Rate: Short

OVERVIEW

This guide can help you better understand the different rules that apply to various types of capital gains, which are typically profits made from taxpayers sale of assets and investments.

|

Key Takeaways Profits you make from selling most assets are known as capital gains, and they are generally taxed at different rates depending on how long you have held the asset. Gains you make from selling assets youve held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your ordinary income, anywhere from 10% to 37%. Gains from the sale of assets youve held for longer than a year are known as long-term capital gains, and they are typically taxed at lower rates than short-term gains and ordinary income, from 0% to 20%, depending on your taxable income. If your investments end up losing money rather than generating gains, you can typically use those losses to reduce your taxes. |

Capital Gains Taxes On Collectibles

If you realize long-term capital gains from the sale of collectibles, such as precious metals, coins or art, they are taxed at a maximum rate of 28%. Remember, short-term capital gains from collectible assets are still taxed as ordinary income. The IRS classifies collectible assets as:

- Works of art, rugs and antiques

- Musical instruments and historical objects

- Stamps and coins

- Alcoholic beverages

- Any metal or gem

The latter point is worth reiterating: The IRS considers precious metals to be collectibles. That means long-term capital gains from the sale of shares in any pass-through investing vehicle that invests in precious metals are generally taxed at the 28% rate.

Recommended Reading: Annual Income After Taxes Calculator

Don’t Miss: File State And Federal Taxes For Free

Percent Capital Gains Rate For Certain Real Estate

However, the rules differ for investment property, which is typically depreciated over time. In this case, a 25 percent rate applies to the part of the gain from selling real estate you depreciated. The IRS wants to recapture some of the tax breaks youve been getting via depreciation throughout the years on assets known as Section 1250 property. Basically, this rule keeps you from getting a double tax break on the same asset.

Youll have to complete the worksheet in the instructions for Schedule D on your tax return to figure your gain for this asset, or your tax software will do the figuring for you. More details on this type of holding and its taxation are available in IRS Publication 544.

If youre considering a real estate investment, compare mortgage rates on Bankrate.

More Help With Capital Gains Calculations And Tax Rates

In most cases, youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses onSchedule D.

If you still have looming questions like, How much is capital gains tax for a specific capital asset I sold this year?, let H& R Block help. Our tax pros know the ins and outs of taxes and are dedicated to making sure youve filed with accuracy, so you get the biggest refund possible guaranteed.

Make an appointmentwith one of our tax pros today.

Or if you prefer to file on your own, H& R Block Premium can help you file your taxes and calculate your capital gains taxes.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

You May Like: What Happens If Your Late Filing Taxes

What Are Capital Gains

Capital gains are the profits you earn from selling an investment. The investment in question is usually an asset like a stock or bond but it can also include things like real estate.

When you sell an asset, you can figure your capital gain by taking the amount you sold it for and subtracting the amount you paid.

For example: If you buy a stock for $50, then sell it for $75, your total capital gain would be $75 $50 = $25.

You can also experience capital losses, where you sell something for less than you paid.

For example: Imagine buying a stock for $50 and then selling it for $40. In that scenario, you would have a capital loss of $50 $40 = $10.

The capital gains taxes you have to pay will be based on your net capital gains. If you sell multiple investments, some for a loss and some for a gain, you have to calculate how much you made overall.

The Impact Of A Capital Gains Tax

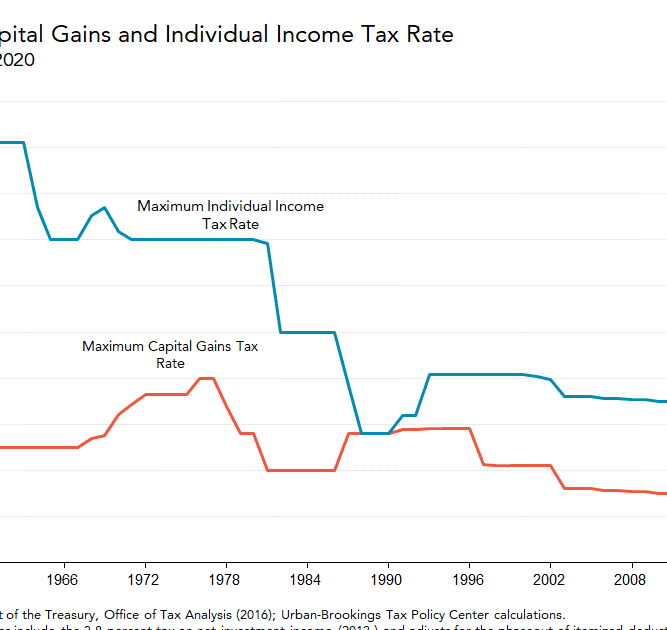

Capital gains taxes affect more than just shareholders there are repercussions across the entire economy. When multiple layers of tax apply to the same dollar, reducing the after-tax return to saving, taxpayers are incentivized to consume immediately rather than save. Take the following example from our primer on capital gains taxes:

Suppose a person makes $1,000 and pays individual income taxes on that income. The person now faces a choice: should I save my after-tax money or should I spend it? Spending it today on a good or service would likely result in paying some state or local sales tax. However, saving it would mean paying an additional layer of tax, such as the capital gains tax, plus the sales tax when the money is eventually used to purchase a good or service. This second layer of tax reduces the potential return that a saver can earn on their savings, thus skewing the decision toward immediate consumption rather than saving. By immediately spending the money, the second layer of tax can be avoided.

You May Like: Free Tax Filing H& r Block

Keep Records Of Your Losses

One strategy to offset your capital gains liability is to sell any underperforming securities, thereby incurring a capital loss. If you dont have any capital gains, realized capital losses could reduce your taxable income by up to $3,000 a year.

Additionally, when capital losses exceed that threshold, you can carry the excess amount into the next tax season and beyond.

For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. The additional $1,000 loss could then offset capital gains or taxable earnings in future years.

This strategy allows you to rid your portfolio of any losing trades while capturing tax benefits.

Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets. Otherwise, the transaction becomes a wash sale.

A wash sale is a transaction where an investor sells an asset to realize tax advantages and purchases an identical investment soon after, often at a lower price. The IRS qualifies such transactions as wash sales, thereby eliminating the tax incentive.

Know The Differences To Get The Most From Your Investment Portfolio

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Also Check: Haven T Received Tax Return

How Do I Calculate Capital Gain On The Sale Of Property

You must first determine your basis in the property. Your basis is your original purchase price plus any fees that you paid minus any depreciation taken. Next, determine your realized amount. Your realized amount is the price that youre selling the property for minus any fees paid by you. Finally, you need to subtract your basis from your realized amount. If the figure is positive, then you will have a capital gain. If the figure is negative, then you will have a capital loss.

You May Like: Rv Sales Tax By State

Calculating Capital Gains And Losses

While you can have a capital gain from the profitable sale of an asset, you can also have a capital loss from the sale of an asset below your purchase price or adjusted basis.

As an example, say you buy and sell stock in the same year up to November. Your trading has netted $10,000 in profits. These profits are classified as short-term gains because theyre less than a year old. Then in December of the same year, you sell more stock for a loss of $3,000. Your capital gain is reduced to $7,000.

A different investor buys and sells some stock during a year and manages to lose $5,000. This investor has a capital loss of $5,000 but can only declare $3,000 for the current year. What happens to the remaining $2,000?

The $2,000 capital loss in the previous example is carried over to the next year. It can be applied as a capital loss. Using another example, our investor has a capital gain of $10,000 in the next year. They can offset this gain and reduce their taxes by the amount carried over from the previous year: $2,000. Their new capital gain is then $8,000.

With capital gains, your capital gain is stacked on top of other ordinary income before the bracket and rate is calculated. This does leave some planning opportunity to try and minimize the taxes paid, but given the 0% bracket is relatively low, it likely means your gains will extend into other brackets.

Recommended Reading: How Long To Get Tax Return

What Is A Capital Asset

Capital assets are investments such as stocks, mutual funds, bonds, real estate, precious metals, coins, fine art, and other collectibles. You’re taxed on the change in value if your investment has an increase in value when a capital asset is sold.

Investments can also produce income in the form of interest, dividends, rents, and royalties. This is taxed as income as it’s generated and isn’t considered to be a capital gain.

How Do You Avoid Paying Capital Gains Taxes On Stocks

There are only three ways in which an investor can avoid paying capital gains on stocks. First, they can trade the stock in a tax-sheltered account, such as a Roth IRA. Second, they can sell a separate stock at a loss to cancel out the profits, this is called tax-loss harvesting. Third, they can avoid paying capital gains taxes by avoiding selling stock. If you have a net profit from capital gains in a taxable account, you can’t avoid capital gains taxes.

You May Like: Can I Still File My 2017 Taxes Electronically In 2021