How To Find Another Company’s Ein

Usually, small business owners need to locate their own company’s tax ID number, but businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .

So, lets talk about how to find your BN.

Finding The Employer Id

If you’re looking for the EIN of a business, there are several places to search.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Read Also: 2021 Short-term Capital Gains Tax

How To Get An Ein

You can apply to the IRS for an EIN in several ways: by phone, fax, or mail, or online. Filing online using the IRS EIN Assistant online application is the easiest way. You can get your number immediately using the online or phone option.

Its a good idea to print out a copy of the application form before you begin the application process. Work through the application questions so you have all the answers youll need.

Who Needs A Federal Tax Id

The IRS requires most business entities to use a federal tax ID corporations, partnerships, most LLCs, and some sole proprietorships. A federal tax ID offers other benefits, even when it isn’t required by the IRS. For instance, it can help protect against identity theft, and it’s often a prerequisite for opening a business bank account.

Don’t Miss: Live In One State Work In Another Taxes

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Finding Property Tax Id Numbers

If the ID number you need to find is for a property you own, you may already have the number in your files. Look on your last tax bill, the deed to your property, a title report or perhaps even on the appraisal report of your property to locate the property ID number. If you cant readily put your hands on any of this paperwork, or if the ID number you need to find is for a property you do not own, you have other search options.

Visit your local tax assessors website and search for the property by its address or, in some cases, the owners name. For some municipalities, you may also find this information on record at your courthouse. If youre unable to find the property ID number with these searches, call the tax assessors office for this information.

Recommended Reading: Pay Federal Estimated Tax Online

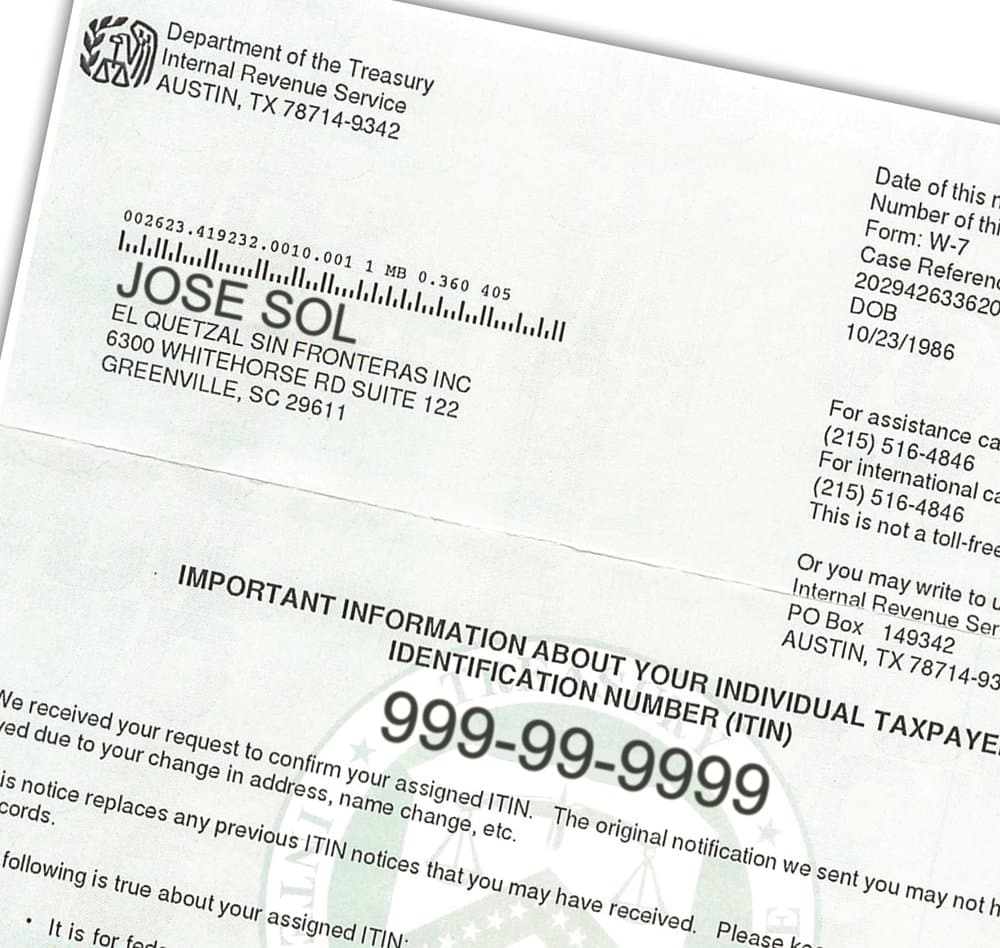

Individual Taxpayer Identification Number

What it is: An individual taxpayer identification number, or ITIN, is a nine-digit tax ID number for nonresident and resident aliens, their spouses and their dependents who cannot get a Social Security number. The IRS issues the ITIN.

How to get an ITIN: To get an ITIN, fill out IRS Form W-7. You must prove your foreign/alien status and identity. Also, you must supply a federal income tax return to your Form W-7 . Organizations called acceptance agents have IRS authorization to help people get ITINs.

Notes:

-

You cant claim the earned income tax credit if youre using an ITIN to file your taxes.

-

ITINs always begin with the number 9.

-

Expirations: Any individual tax ID number not used on a tax return at least once for tax years 2018, 2019 or 2020 expired at the end of 2021. ITINs with middle digits containing 70 through 88, and 90 through 99 , have also expired.

Can I Use My Ein To Rent An Apartment

You can use an EIN to rent an apartment as long as you will be conducting business in the dwelling. This can become complicated, and you will need a lawyers help to figure out how to use your number for this purpose. I can assist you in this respect, as you will be using the space for both personal and work activities. Contact me for further details at sam@mollaeilaw.com.

You May Like: How Much In Inheritance Tax

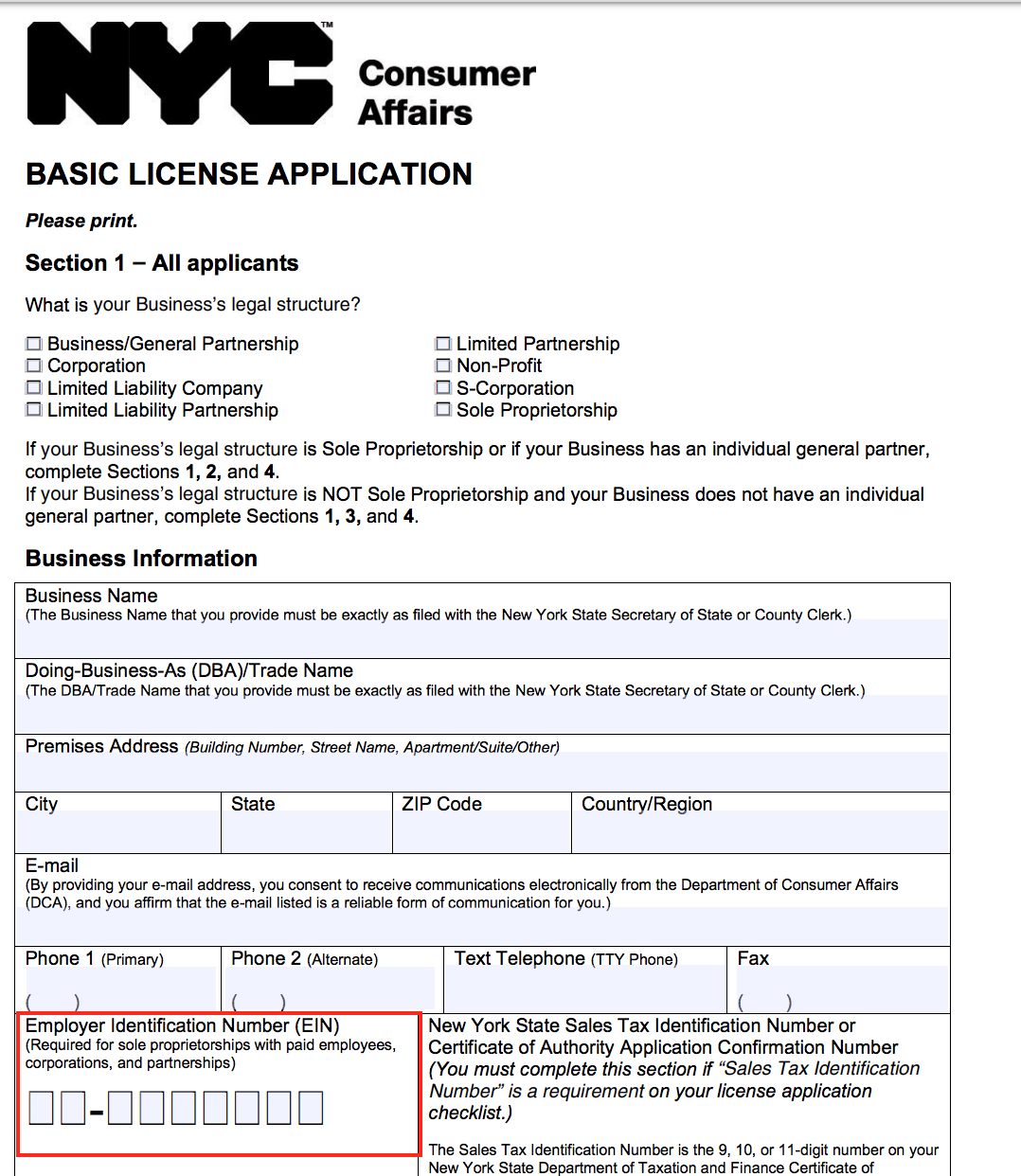

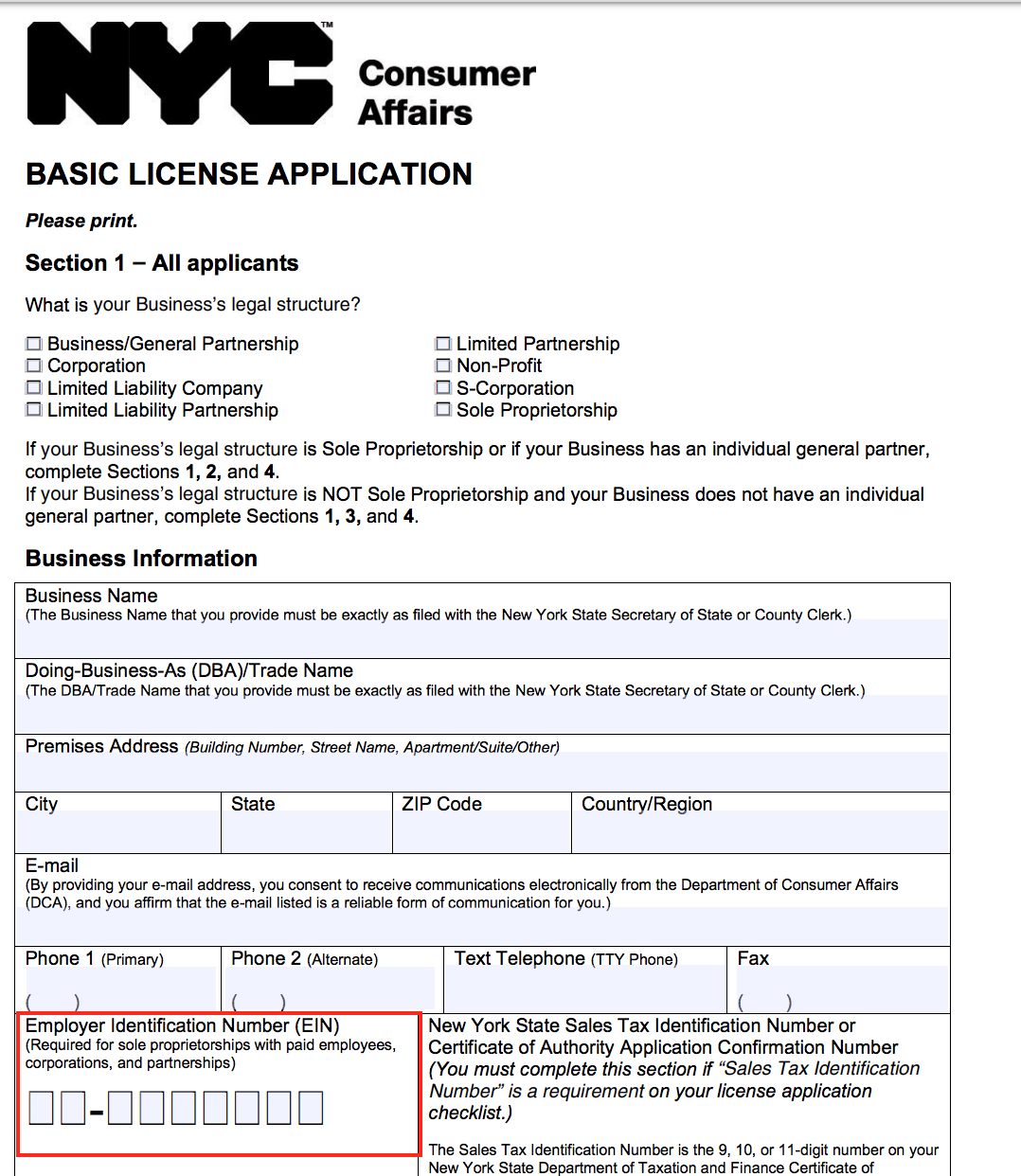

Get Ein To Apply For Business Permits

Perhaps, you want to apply and get business permits for your business. But you are still wondering what is an EIN number and what is an EIN used for. In this case, you will need it the most in your own business.

After knowing how to start a business in the USA for non-citizens, you should apply for your EIN number.

Before you open a business, you also need to apply and get the necessary licenses and permits for operating your business.

Virtually, every business needs some form of license or permit to operate legally. These may include business licenses, sellers permit, or a zoning permit, among many others.

Licenses and permits vary by the type of business you operate and where your business is located. Every business needs a basic operating license or permit even if youre home-based.

Q5 I Am Not Sure If I Qualify To Claim The Dependency Exemption Or Child And Dependent Care Credit For The Child I Am Adopting How Can I Find Out

A5. To know whether you qualify to claim the child’s exemption or child care credit for the child, see “Exemptions and Credit for Child” and “Dependent Care Expenses” in the Form 1040 InstructionsPDF. For further information, see Publication 501, Exemptions, Standard Deductions and Filing InformationPDF and Publication 503, Child and Dependent Care ExpensesPDF. You may order copies of these publications by calling .

If you are still not sure, you may call or come to any IRS walk-in office for assistance.

Read Also: H& r Block Tax Identity Shield

How To Find State Tax Id Number For A Company

Most businesses must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan.3 min read

Need to know how to find a state tax ID number for a company? Most types of business entities must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan. This EIN, also known as a business tax ID number or federal tax ID number, is a nine-digit number that the IRS uses to identify a business.

Whether or not your company employs workers, you’ll probably need this number for federal tax filing purposes. However, not every company needs an EIN. In some instances, a sole proprietor without any employees can simply use their own social security number.

Some states may require your business to have an EIN prior to completing state tax forms or registering your company within the state. In addition to tax filing, the EIN is used to identify a business in order to process a business license or satisfy other state requirements. For example, California State requires most businesses to have an EIN prior to registering state payroll taxes.

Make Sure Your Business Qualifies

To qualify for an EIN, your business must operate within the United States. As the business owner applying for the EIN, you must have a valid taxpayer identification number, such as a Social Security number or individual taxpayer identification number. Check the list of questions above to see if your business qualifies for a federal tax ID number. You can also find helpful information in the IRS online FAQ.

You May Like: Department Of Tax Debt And Financial Settlement Services

Can I Use My Social Security Number Instead Of An Ein

Yes. You can use your social security number instead of an EIN if you are signing up for business credit or a loan. In fact, most issuers of business credit will base their decisions on your personal credit history, so they typically require that you furnish an SSN as well. I can help you with obtaining an EIN for business purposes. Check with me via email at sam@mollaeilaw.com.

How Do I Find An Ein

For a company, an EIN is similar to a social security number for an individual. As such, most companies keep their tax ID numbers private, so you probably won’t find it published on the company’s website. However, many documents require the number. If you’re an employee of a company, look in box B on your W-2 statement. If you’re an independent contractor, you can find this number in the Payer’s Federal Identification Number box on Form 1099.

If you’re an employee of a company and have been unable to find your company’s EIN, you may call or e-mail the Department of Revenue for your state. You’ll need to provide your employer’s legal company name and any additional required information.

If you have a valid reason to know a business’s EIN, you can simply call the business and ask for it. If you are dealing with a small company, you can speak with the company owner or your usual contact person. If you are dealing with a large company, get in touch with the accounts payable department if you need to send an invoice. If you’ve received an invoice from a company, contact that company’s accounts receivable department. This is usually the contact person whose name is printed on the invoice.

If you are providing a product or service to another company and would like to know whether that company qualifies for tax exemption, you can ask your customer for the number. In some situations, this number will appear on a state-issued certificate.

Read Also: Selling House Capital Gain Tax

How To Find Your Employer Identification Number

An Employer ID Number is an important tax identifier for your business. It works in the same way a Social Security number does for individuals, and almost every business needs one. The most important reason for an EIN is to identify your business for federal income tax purposes, but its also used to apply for business bank accounts, loans, or credit cards, and for state and local taxes, licenses, and other registrations .

Get Ein To Open A Bank Account In The Usa

Most banks require businesses to present an EIN to open any business bank account.

You will be turned away if you try to open an account without your EIN. This gives you a hint about what is the EIN number. Thats when youll know how important EIN number uses are.

Your bank will use the EIN to confirm with the tax authority the legitimacy of your firm.

Once you have the EIN for foreign entity your account can be opened anywhere in the world. This also means that now you know what is EIN number and what is an EIN used for.

Typically, U.S. banks will need someone to show up in person, with formation documents, and EIN for the company.

Each bank has different policies for dealing with businesses with foreign ownership. While traveling to the country of your business origin, bring all necessary documents for opening the bank account.

These documents may include your EIN letter and certificate of incorporation. Plus, you also need to bring two pieces of photo identification.

Also, generally, you can go to a U.S. bank that also has locations locally for assistance in opening the US bank account. By now, you must be able to answer what is an EIN number.

Don’t Miss: What State Has The Lowest Sales Tax

Indiana Registered Retail Merchant Certificate

Register for an Indiana Registered Retail Merchant Certificate Online by filling out and submitting the State Sales Tax Registration form. This certificate will furnish your business with a unique sales tax number . Once you complete the online process, you will receive a confirmation with all relevant important information within 1-2 business days. Shortly after that, you will receive your documents directly from the Indiana Department of Revenue and your INBiz account will be ready for future use.

Ein Lookup: How To Find Your Business Tax Id Number

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

A business tax ID number, also called an employer identification number or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

How Much Do You Need?

Most people know their social security number by heart, but not all business owners know their business tax ID number. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as remembering your company’s phone number or address.

However, your EIN is essential for some very important business transactions, like filing business taxes and obtaining small business loans. Accuracy and speed matter in those situations. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a business tax deadline.

How to find your business tax ID number:

Check your EIN confirmation letter

Check other places your EIN could be recorded

Also Check: 401k Roth Vs Pre Tax

Does My Business Need A Federal Tax Id Number

A business needs a federal tax ID number in order to apply for a business bank account or loan. Here are several other questions to help you figure out whether your business might need a federal tax ID number:

- Do you have employees?

- Do you withhold taxes on any income other than wages paid to a nonresident alien?

- Is your business a partnership or corporation?

- Is your business involved with mortgage investments?

- Is your business involved with real estate conduits?

- Is your business involved with nonprofit organizations?

- Does your business handle estates, trusts or IRAs?

- Do you file a return for tobacco, employment, alcohol, firearms or excise taxes?

If the answer to any of these questions is yes, your business likely needs a tax ID. For more information visit IRS.gov

If your business is tax-exempt, you still have to apply for an EIN. However, you must make sure your business meets the tax exemption requirements before you apply for an EIN.

Upon applying for an EIN, tax-exempt businesses have three years to prove their status. You dont want to spend any of that time trying to jump through legal hoops and requirements to meet the tax-exempt regulations.

Locating Your Own Ein

If you have lost track of your businessâ EIN, the good news is that there are a number of ways that you can locate it.

In order to find your EIN, the IRS recommends taking the following measures:

- Check Your IRS Notice â When you apply for an EIN for your business, the IRS automatically sends out a notice both to confirm your application and to confirm your receipt of an EIN. Your EIN Number can be found on either of these two notices.

- Review Old Applications â If you used your companyâs EIN in order to apply for a business bank account or a federal license, you can review your EIN application or reach out to the bank or agency involved in order to retrieve your EIN.

- Find Previous Tax Returns â If you have already filed a tax return under this business, you can pull them up to find your EIN number, your federal tax ID number.

- Contact the IRS â If all else fails and you still cannot find your businessâ EIN, you can always reach out to the IRSâs Business & Specialty Tax Line, where an assistor can help track down your EIN.

While most of the time, you will only need to know your own businessâ EIN, there are certain occasions when you may need to look up another businessâ EIN in order to verify their information.

You May Like: Do You Have To Pay Taxes On Inheritance