Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Who Is Required To File Quarterly Taxes

If you work as a self-employed individual or small business owner, you likely need to pay quarterly estimated taxes. You’re typically considered self-employed if you work as:

- An independent contractor

- A member of a partnership that conducts business, such as an LLC

- A person who runs a business as your own, including part-time

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Read Also: Which States Do Not Tax Pension

How To Avoid Federal Tax Penalties

You can avoid federal penalties by paying, over the course of the year, the lesser of 90% of your 2022 taxes or 100% of your 2021 bill if your adjusted gross income is $150,000 or less.

“As long as you pay that amount into the system, your income could quadruple and it does not matter,” Loyd said. “You won’t have an estimated tax penalty.”

Of course, you’ll still need to set aside enough money to cover total levies for the year when you file taxes in April, he said.

Underpayment Of Estimated Income Tax

An addition to tax is imposed by law if at least 90% of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax except in certain situations. The addition to tax does not apply if each required installment is paid on time and meets one of the following exceptions:

- Is at least 90% of amount due based on annualized income

- Is at least 90% of amount due based on the actual taxable income

- Is based on a tax computed by using your income for the preceding taxable year and the current year’s tax rates and exemptions

- Is equal to or exceeds the prior year’s tax liability for each installment period and the prior year return was for a full year and reflected an income tax liability or

- The sum of all installment underpayments for the taxable year is $150 or less

If you do not qualify for an exception, your underpayment computation will be based on 90% of the current year’s income tax liability or 100% of your liability for the preceding year, whichever is less. The addition to tax is computed on Form 760C .

Don’t Miss: Can I Pay Estimated Taxes All At Once

How Do I Make Estimated Quarterly Tax Payments If My Income Fluctuates

The IRS allows you to make estimated quarterly payments based on your income for each quarter. To calculate that, you need to use the Annualized ES Worksheet for the tax year in question. This form requires similar information as Form 1040-ES, but it breaks everything down quarterly rather than annually.

People Who Arent Having Enough Withheld

The IRS says you need to pay estimated quarterly taxes if you expect:

Youll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller. The threshold is 110% if your adjusted gross income last year was more than $150,000, or $75,000 for married filing separately.

Don’t Miss: Department Of Tax Debt And Financial Settlement Services

What If I Dont Pay Enough Towards My Quarterly Taxes

Just like youll get hit with a penalty if you dont pay your quarterly taxes, youll also pay a penalty if you dont pay enough towards your quarterly taxes.

The underpayment penalty rate is still 6%, but this time the penalty paid is on how much you underpaid.

The IRS isnt always such a Heather, though. You wont be penalized if you pay at least 90% of your total tax liability through quarterly payments.

Also, if you pay 100% of your previous years tax liability through quarterly tax payments, youll avoid the underpayment penalty.

The only caveat is if you earn more than $75,000 as a single filer or $150,000 as a married filer. Then youll need to pay 110% of the previous years tax liability to avoid a penalty.

Just like Steve Urkel was the breakout star of Family Matters, your quarterly tax payments could be the breakout star of your finances.

Next year at tax time you could be celebrating a stress-free tax season with a pre-paid tax bill, leaving you enough cash in the bank for that accordion youve always wanted.

How To Figure Estimated Tax

To figure estimated tax, individuals must figure their expected Adjusted Gross Income , taxable income, taxes, deductions and credits for the year.

When figuring 2022 estimated tax, it may be helpful to use income, deductions and credits for 2021 as a starting point. Use the 2021 federal tax return as a guide. Taxpayers can use Form 1040-ES to figure their estimated tax.

The Tax Withholding Estimator on IRS.gov offers taxpayers a clear, step-by-step method to have their employers withhold the right amount of tax from their paycheck. It also has instructions to file a new Form W-4 to give to their employer to adjust the amount withheld each payday.

Don’t Miss: Sales Tax In Houston Tx

Pay Estimated Taxes By Mail

To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment. You dont have to include the worksheet with your calculations. To be considered on time, the form must be postmarked by the due date. To find the address, refer to page five of the 1040-es document. The address is determined based on your location.

Who Should Pay Estimated Taxes

The IRS uses a pay-as-you-go income tax system, meaning you must pay your taxes as you earn income. It enforces this by charging penalties for underpayment if you haven’t paid enough income taxes through withholding or making quarterly estimated payments. It also charges penalties on late payments even if you end up getting a refund.

The IRS uses a couple of rules to determine if you need to make quarterly estimated tax payments:

- You expect to owe more than $1,000 after subtracting withholding and tax credits when filing your return, or

- You expect your withholding and tax credits to be less than:

- 90% of your estimated tax liability for the current tax year

- 100% of the previous year’s tax liability, assuming it covers all 12 months of the calendar year

These are commonly referred to as safe harbor rules. The 100% requirement increases to 110% if your adjusted gross income exceeds $150,000 .

One exception applies to individuals who earn at least two-thirds of their income from farming or fishing. The requirement is to pay in two-thirds of your current year tax or 100% of your prior year tax. Also, there is only one estimated tax payment date – January 15 of the following year. Additionally, if you file and pay in full by March 1, then estimated tax payments are not required.

Recommended Reading: How Much Taxes Deducted From Paycheck Pa

How Do I Pay My Estimated Taxes

When filing your estimated taxes, use the 1040-ES IRS tax form, or the 1120-W form if you’re filing as a corporation. You can fill out the form manually with the help of the included worksheets, or you can rely on your favorite tax software or tax adviser to walk you through the process and get the job done. From there, you can pay your federal taxes by mail or online through the IRS website. You’ll also find a complete list of accepted payment methods and options, including installment plans.

How Can I Pay Estimated Tax

Now that you know what you owe, its time to get your payment in. Fortunately, you have several options:

- QuickBooks Self-Employed allows you to electronically file your quarterly estimated tax payments to the IRS. E-filing is fast and results in fewer errors because you wont have to re-enter information into your checkbook or the IRS computer system.

- You can use the Electronic Federal Tax Payment System to pay your estimated taxes. Besides making instant payments, its also free.

- You can mail in your payment. The IRS has specific mailing addresses based on the state where you live. Please be aware that your payments should be postmarked by the due date to avoid penalties.

Also Check: Capital Gains Tax On Cryptocurrency

Nerships & S Corporations

Estimated tax is the method used to pay tax on income that is not subject to withholding. Individuals who are not residents of Colorado must pay tax on any Colorado-source income. This is intended for nonresident individuals who are included in a partnership or S corporation composite filing. In most cases, you will pay estimated tax if an individual partner expects to owe more than $1,000 in net tax for the year, after subtracting any withholding or refundable credits they might have. This rule must be calculated for each individual included in the composite return, and not as the composite as a whole. Use the Partnerships and S Corporation Estimated Payment Form to submit your business’ estimated payments.

You may also use Revenue Online to submit your partnership or S corporation estimated payments.

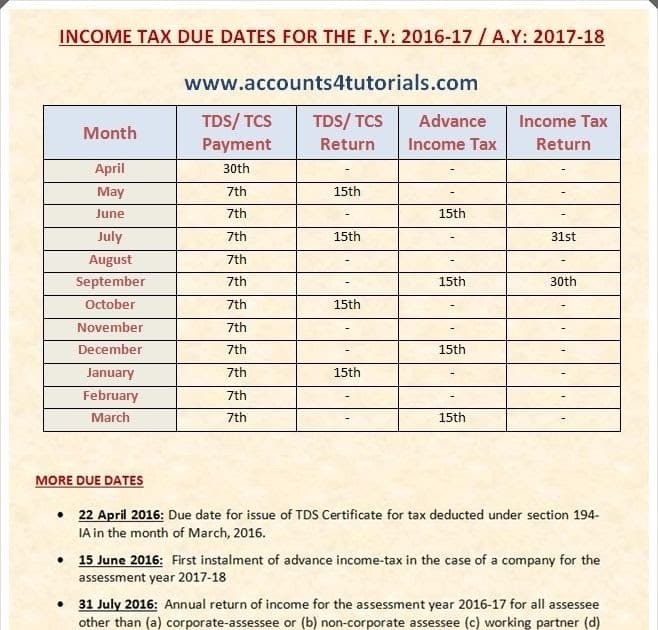

When Are Quarterly Estimated Tax Payments Due

Payments for the January 1st to March 31st period are due April 15th for April 1st to May 31st, payments are due June 15th for June 1st to August 31st, payments are due September 15th and for September 1st to December 31st, payments are due January 15th of the following calendar year. This is the general standard payment schedule for normal tax years.

When these dates fall on a holiday or a weekend, the due date moves to the next business day. Here are the due dates for tax years 2017 through 2019.

You May Like: California State Capital Gains Tax

How Will I Know If I Need To Make An Estimated Payment

If you are required to file a tax return and your Virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Who Is Subject To Estimated Taxes

In the United States, we have a pay as you go tax system. That means that the government expects to receive most of your taxes throughout the year. Because of this, employees have a certain amount of taxes automatically withheld from their paychecks.

On the other hand, if you are self-employed as a freelancer, contractor or home-based entrepreneur, you most likely dont have taxes withheld from your pay throughout the year and are instead subject to quarterly estimated taxes. In general, you are expected to pay estimated taxes if you expect to owe $1,000 or more annually for your taxes.

For your 2022 taxes, the next quarterly estimated tax deadline is coming up on September 15, 2022!

However, if you skip making a quarterly payment or pay late, you may be subject to a penalty. If you earn your self-employment income unevenly during the year, you may be able to use an annualized installment method at tax time and avoid a tax penalty for not paying estimated taxes every quarter due to fluctuating income.

You May Like: How To File Self Employed Taxes

Can I File An Extension

As in past years, you can request an extension if you need more time to prepare and file your 2021 return. Before the April 18, 2022, deadline, you must fill out and submit Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. At the time you file Form 4868, you must also pay the estimated income tax you owe to avoid penalties and interest, the IRS says.

Generally, taxpayers are granted an automatic six-month extension to file, or two months if theyre out of the country, in which case the extension also applies to payment of taxes owed.

To qualify for an extension, you must file Form 4868 before April 18, 2022. You will not be notified unless your request is denied.

People Who Aren’t Having Enough Withheld

The IRS says you need to pay estimated quarterly taxes if you expect:

You’ll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller. The threshold is 110% if your adjusted gross income last year was more than $150,000, or $75,000 for married filing separately.

Don’t Miss: Montgomery County Texas Property Tax

Due Dates For 2022 Estimated Tax Payments

There are some rules that allow you to stray from the set schedule above. For instance, if you paid all your 2022 estimated taxes by April 18, you’re off the hook for the rest of the year . If you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return, then you don’t have to make the final payment due January 17.

Who Does Not Have To Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck.

You dont have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident alien for the whole year

- Your prior tax year covered a 12-month period

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

Don’t Miss: How Much Will I Get Paid After Taxes

Pay Estimated Taxes Via Electronic Federal Tax Payment System

You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment. The IRS sends you a PIN in the mail to complete your enrollment.

Determine If You Need To Pay Quarterly Taxes

If youre a small business owner, a freelancer, a contractor or a moonlighter, youll likely owe quarterly taxes. Investors with sizable capital gains may also have to pay quarterly taxes.

According to the IRS, if you expect to owe a tax bill of at least $1,000 for the tax year, you must make estimated quarterly tax payments. This doesnt include income tax that is withheld by your employer if you also have a salaried or hourly position. Youll also subtract any refundable credits when determining if your tax obligation meets the $1,000 threshold.

If you underpay in a given quarter, you could be charged a penalty. This is true even if youre due a tax refund when you file your annual return. More on this later.

Dont Miss: How Long Will It Take For My Tax Return

Don’t Miss: How To File An Extension Taxes

How Do I Make Sure I Have Enough Money For My Quarterly Taxes

The biggest reason people blow off their quarterly tax payments is that they dont have the cash to pay them. The best way to prepare for your quarterly taxes is to save for them monthly.

If you have a fixed amount you pay every quarter, divide that amount by three. That becomes your monthly tax savings.

If youre using the real-time method, every month multiply your taxable profit by 25-30%. That becomes your monthly tax savings.

The last, and most important, step is to transfer your monthly tax savings into a dedicated tax savings account. This ensures that you dont dip into your quarterly tax payment money and you have the money to stay on top of your payments.